Want to know about California ADU Grants and Loan Programs? If Yes, You are at the right place.

In this article, we are sharing all the information about California ADU Grants and Loan Programs.

ADU Grant and Loan Programs in California present what arguably is the state’s most innovative ever initiative aimed at positively restructuring its housing landscape. ADUs serve as versatile secondary structures under this ambitious initiative spearheaded by CalHFA. ADU construction expenses, such as preparation work and permits, can be covered with up to $40,000 in support from the program. The eligibility criteria for aid are stringent to ensure equitable distribution.

Using this innovative approach, California provides housing solutions while simultaneously empowering homeowners. If you want to learn more about California’s ADU Grant and Loan Programs, read our complete guide. We have covered every aspect of the program you need to know.

Table of Contents

What is California ADU Grants and Loan Programs?

California’s Accessory Dwelling Unit Grants and Loans program is a government initiative created to address the state’s affordable housing crisis and promote the construction of Accessory Dwelling Units (ADUs). As the name suggests, ADUs are secondary housing units located on residential properties, often referred to as granny flats, in-law suites, backyard cottages, or granny flats located on the property. This program provides homeowners with financial assistance to build or renovate their ADUs on their properties.

Similarly, Home Improvement Grants For Seniors In Michigan offer vital support, ensuring elderly citizens can maintain safe living spaces. These initiatives exemplify states’ commitments to enhancing housing options and improving the quality of life for their residents.

How Does California ADU Grant Program Work?

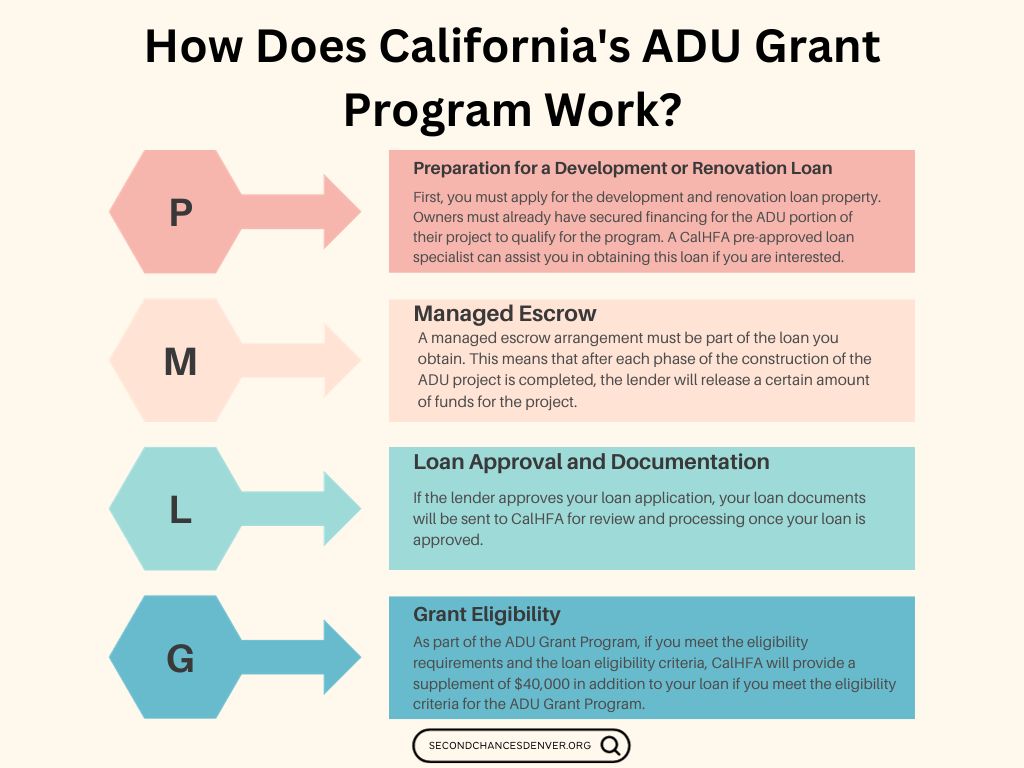

The CalHFA ADU Grant Program operates in several steps such as –

Preparation for a Development or Renovation Loan: First, you must apply for the development and renovation loan property. Owners must already have secured financing for the ADU portion of their project to qualify for the program. A CalHFA pre-approved loan specialist can assist you in obtaining this loan if you are interested.

Managed Escrow: A managed escrow arrangement must be part of the loan you obtain. This means that after each phase of the construction of the ADU project is completed, the lender will release a certain amount of funds for the project.

Loan Approval and Documentation: If the lender approves your loan application, your loan documents will be sent to CalHFA for review and processing once your loan is approved.

Grant Eligibility: As part of the ADU Grant Program, if you meet the eligibility requirements and the loan eligibility criteria, CalHFA will provide a supplement of $40,000 in addition to your loan if you meet the eligibility criteria for the ADU Grant Program.

Accordingly, an ADU project of $200,000 would receive a $160,000 contribution from the lender, while an additional $40,000 to the project by CalHFA on top of the lender’s contribution.

Does the ADU Grant Cover Expenses?

In the case of ADU (Accessory Dwelling Unit) Grants, the expenses covered by the grant can vary greatly depending on the particular grant program or organization providing the funding. An accessory dwelling unit grant may be used to cover expenses associated with the construction, renovation, or improvement of an accessory dwelling unit, a secondary housing unit on a property attached to the primary residence.

Examples of these expenses are construction costs, architectural and design fees, licensing fees, utility connection fees, and other costs directly related to the development of the ADU. ADU grants may also cover costs related to housing initiatives, affordable housing shortages, the development of sustainable and inclusive communities, and other expenses related to affordable housing.

Whenever you are looking for the exact expenses that your ADU Grant will cover, it is essential to refer to the guidelines and terms of the program or organization that is providing the funding, as there may be specific criteria and limitations that must be followed.

Eligibility Criteria for the CalHFA ADU Grant

Applicants who are interested in applying for a CalHFA ADU Grant must meet specific criteria, which include

Property Ownership and Residency: The applicant must reside where the Accessory Dwelling Unit (ADU) will be built and own the property.

The program is available to single-family homes or properties with 2-4 units.

Income Limits: Income limits for applicants must be within the range of low-to-moderate incomes. These income limits are essential to keep in mind since they apply to the individuals who are borrowers (property owners) and not to the entire household as a whole.

In California, there are different income limits for each county. According to California law, the maximum amount of income that can be earned in counties such as Del Norte and Imperial can be as high as $159,000, while in counties such as San Francisco and Santa Clara, it can be as high as $300,000.

Additional Lender Criteria: Applicants should be aware that the lender may impose additional criteria for the loan they are applying for. A lender’s criteria for loan approval can vary based on loan type.

How to Apply for California ADU Grants?

If you are interested in applying for a California ADU Grant, you can follow these steps:

Step 1: Be sure to check your eligibility before applying for the California ADU Grant, as you must meet the program’s eligibility criteria to be eligible for the grant. In most cases, these criteria will include the following:

- Living on the property where the ADU is to be built and owning the property where the ADU is to be built.

- Your income is in the range of low-to-moderate income for your locality. Based on your location within California, these income limits may be different depending on the amount of income you earn.

- It is required that the ADU be located within a home that is a single-family home or a duplex.

- The ADU must be at least 1,200 square feet in size, which is usually the minimum number.

- Making sure that your ADU project complies with all local zoning and building regulations, as well as the obtaining of the required permits, is crucial.

Step 2: You must find a lender who participates in the CalHFA ADU grant program to secure and access the grant funds for your ADU project. The lender must be a lender that participates in the CalHFA ADU grant program. Lenders who are familiar with the program’s requirements and have experience with the application process can significantly help you during the application process.

Step 3: The CalHFA ADU grant application form can be downloaded from the official CalHFA website. You will need to complete the CalHFA ADU grant application form. During this application process, you will be asked to provide detailed information about your financial situation, including your income, assets, and liabilities. As part of your application, we will also need information about the location and specifications of your ADU project.

Step 4: Make sure you check CalHFA’s application deadline, typically around the beginning of March of each year, before submitting your application. CalHFA must receive your completed application by the deadline for your application to be considered. When submitting your application, ensure you include all the required documentation.

Step 5: CalHFA will thoroughly review your application to determine if you meet the eligibility requirements for the California ADU Grant Program and the eligibility criteria for the California ADU Fund. As part of the assessment process, your income, ownership of real estate, and compliance with program requirements will be examined. Due to this review process, there might be a waiting period, so be prepared for a long wait.

Step 6: The approval of your application and the disbursement of your grant. If your application is approved, CalHFA will provide you with a grant for $40,000. We are offering this grant to provide you with a financial contribution for the costs associated with the pre-construction of your ADU. You must follow CalHFA’s guidelines when using these funds and provide documentation of how the funds are being utilized if required by CalHFA.

Step 7: You must prepare detailed plans for the construction of your ADU before you can apply for the grant for construction. You will usually be required to provide architectural drawings, structural plans, and any other documentation required by your mortgage lender or local building authorities. These plans may require the services of an architect or general contractor to be prepared.

Step 8: After you have provided the lender with the necessary plans and documentation, the lender can hire an appraiser to assess the value of your property, including the ADU, once you have provided the lender with the necessary documentation. A property appraisal is necessary to determine eligibility for a loan based on home value. Your lender will then be able to begin the loan application process with this information, which may include additional requirements and documentation.

Benefits of California ADU Grants and Loan Programs

California ADU grants and loan program offers many benefits to homeowners. Here are some significant benefits:

1. Purpose and Importance: This program aims to alleviate California’s severe housing shortage by increasing the availability of affordable housing options in the state. It is cost-effective to provide more housing units in already established neighborhoods while adding additional rental income to homeowners.

2. Administration: Several ADU grant and loan programs in California are available through the California Housing Finance Agency (CalHFA). This state agency provides affordable housing financing and assistance through grants and loans.

3. Financial Support: These programs provide financial assistance to homeowners to cover the cost of constructing or renovating ADUs.

4. Grant Program: Grants of up to $40000 are available to homeowners as part of the ADU Grant Program. The grants help to cut down the pocket expenses of the homeowners. Homeowner The expenses that may be considered eligible include architectural designs, permits, site preparations, impact fees, property surveys, and energy reports.

5. Loan Program: Homeowners can also get loans through these programs and grants. This program complements the grant program by providing additional funding for constructing ADUs. Among the factors that CalHFA considers when setting loan terms and conditions are interest rates, repayment options, and loan terms.

6. Eligibility Criteria: Homeowners must meet specific criteria such as income limits and credit scores. These criteria ensure that those who need help the most can benefit from these programs.

Possible Drawbacks of California ADU Grants

ADUs (Accessory Dwelling Units) in California can offer several benefits to homeowners and communities, including the opportunity to increase housing supply and income from rental properties. While they are helpful and valuable, they also come with several disadvantages and challenges that should also be taken into account:

Limited Funding Availability: Depending on the state of California, a limited amount of money is allocated to the California ADU grants, so competition for these grants is often fierce. Not all eligible applicants may receive funding, causing some homeowners to be unable to realize their dream of having an ADU.

Eligibility Criteria and Complexity: It is not uncommon for grants to have specific eligibility criteria, such as income limits or property requirements, as part of their application process. Some homeowners may feel hesitant to take on the construction of an ADU as it can be difficult and time-consuming to navigate these criteria and the application process. This could encourage some homeowners to pursue this project.

Administrative Delays: It is typical for the application and approval process for ADU grants to be lengthy and bureaucratic, which can cause construction to be delayed. There is often frustration associated with this for homeowners who want to quickly find a solution to their housing needs or earn income as a renter.

Cost Limitations: The cost of constructing an ADU may not be covered by the ADU grant funds, meaning that homeowners may have to invest significant sums of their own money to complete the project. When a person has limited financial resources, this financial burden can be a significant drawback.

Zoning and Regulatory Challenges: Challenges might be associated with zoning and regulatory requirements in the homeowner’s local jurisdiction, even if they receive grant funding. It can be challenging to navigate the ADU construction process due to the wide variations in zoning laws, building codes, and permits that must be complied with.

Some residents and community organizations can raise concerns about how the construction of ADUs could affect the overall character of their neighborhood, such as a possible increase in population density, a reduction in parking availability, and changes to the overall aesthetic of the neighborhood.

FAQs Related to California ADU Grants

What is a California ADU Grants?

Homeowners in California can apply for ADU grants to build an additional living space on their property. As part of the program, it provides funding to offset the costs associated with construction and promote affordable housing.

How Do I Finance an ADU in California?

Among the many ways ADUs can be financed in California are personal savings, home equity loans, construction loans, grants, and various state and local programs available to help. The California housing website can provide you with more information, or you can consult a financial advisor.

How Can I Utilize the ADU?

The ADU you build can be used in various ways once constructed. Regarding renting the apartment, you are only restricted from renting it out short-term. However, it can also be used as a long-term rental property, a family accommodation, or a commercial property. As part of the CalHFA’s mission, our goal is to promote affordable housing, and these options align with that goal.

Will I be Taxed on The Grant Money?

The grant funds will be credited to your account as a 1099. If you want to understand the potential tax implications for your annual taxes, CalHFA strongly recommends consulting with a tax professional or accountant.

Are There Any Upfront Expenses I Need to Cover?

You may have to pay an upfront fee if you plan on securing a loan for your ADU, which could result in architectural plans and drawings being required for your project. The grant will, however, reimburse you for these costs to the extent that they can be justified. Even though the reimbursement won’t be direct, the principal amount of the loan will be reduced due to the reimbursement. In many cases, these upfront expenses can be as high as $20,000, so it is essential to keep that in mind.

What Happens if I Abandon the Project? Can I still Receive the Grant?

It is possible to do so, but it will depend on your lender’s conditions. To understand your lender’s specific requirements and policies, you must discuss this with them before you begin working on the project.

Conclusion

As part of the California ADU Grants Program, funds can be provided to assist with the construction of ADUs. If you want to apply to CalHFA or your local housing authority, you should do so as early as possible. There is a significant possibility of reducing the cost of ADU construction. Grants like these increase the value of properties and make them more livable.

People must have access to technology today, such as laptops. Students and low-income individuals can bridge the digital divide with free laptop grants. Ensure you are up-to-date on grants and funding opportunities to help you live a better life and access essential tools. California ADU Grants are essential for a thriving future, and technology is also vital.