Are you familiar with Churches That Help With Car Payments. Yes, you read correctly.

In the United States, many charities offer assistance with car payments. Government programs and churches can also help. This article will walk you through the different options you have.

There are times in life when things just happen, and it’s hard to cope. Fortunately, many organizations can assist with your difficult situation, and we have listed them all below under subheadings so you can easily find them.

The article provides all the information regarding Churches That Help With Car Payments, how they work, and how to find them.

Now, let’s get started.

Table of Contents

What Are Church Grants?

In terms of money, a grant is like a special gift from the government or a nonprofit organization. When an organization such as a church receives a grant, they don’t have to repay it. The donation is a generous one-time gift but on a larger scale.

Church grants are usually given to churches for specific needs and must be used for those needs. This supports the Church in a targeted and impactful manner.

What is A Car Payment?

If you’re thinking of getting a brand-new car, one that you really, really want, that car begins to appear everywhere—in your dreams, on your drive to work, even parked in front of your favorite coffee shop.

The problem is that you don’t have thousands of dollars lying around. Therefore, you finance it the way most people do. Suddenly, you’re in the dealership, shaking hands, and driving away with a brand-new vehicle . . . along with a car note.

Is there such a thing as a car note? The majority of people refer to it as a car payment. Nevertheless, when you finance a car, you are not actually the owner. Essentially, you’re borrowing money from the lender and promising to repay their loan (plus interest) within a certain time frame. Your car note (a car payment) is your monthly payment.

How Are Car Payments Calculated?

A car payment is calculated using several factors when you finance it:

- Car price at the moment

- Your previous trade-in value

- Down payment money

- Amount of the loan (principal)

- Loan interest rate

The length of time it will take you to pay off the loan (also known as the loan term)

List of Churches That Help With Car Payments

Lutheran Services

The Lutheran Services in America network has more than 300 agencies providing health and human services. They’ve empowered more than six million people in over 1,400 communities together! This organization makes an extraordinary impact.

The company does not appear to offer car payment assistance programs. However, since its overall mission is to help people become self-sufficient and independent, it seems like it would fit with its objectives. Don’t be afraid to ask!

St. Vincent De Paul

The institution is one of the largest in the world. Their services are available in 140 countries, and they have over 8 lakh subscribers. As a result of their concern for the needy, they have always provided assistance to the needy through different programs.

They provide food, shelter, and other necessities to the needy. They assist with automobile repairs. The St. Vincent De Paul church may be able to assist low-income individuals who can’t fix their cars. In order to accomplish this operation, they collaborated with local mechanics.

The Salvation Army

Salvation Army is one of the most well-known church aid organizations in the United States. Their services include food pantries, disaster relief, and social services. They generate revenue from their thrift stores, which sell donated items. The Salvation Army is known for its comprehensive emergency assistance programs, including car loan assistance.

Their goal is to prevent homelessness and help people maintain employment, which often requires reliable transportation. Furthermore, they offer a Car Repair Assistance program for customers who need their automobiles fixed for free or at a very low cost. A Salvation Army branch near you can provide application forms for such people.

Church of Jesus Christ of Latter-day Saints

In the Church of Jesus Christ of Latter-day Saints, fast-offering donations are used to provide financial assistance to members. The Church fasts two meals every month and donates the money saved to help those in need in their communities.

Every congregation has a bishop who administers these funds. The funds are generally reserved for the benefit of members of the ward, but may be used in limited circumstances for the benefit of non-members as well.

Catholic Charities

Catholic charities are always committed to helping the poor out of love for them. Low-income people who cannot afford car repair costs, rent, food, and other means of living have numerous strategies and plans available. The Catholic Charities can help you when you face a crisis with your car. A Catholic charity may be able to provide you with assistance if you need to cover the costs of your car payment. You can get this type of assistance from local catholic charities near you.

Car Ministry Program

The organization helps widows, single mothers, and those needing financial assistance with automobile repairs in the local community. Their volunteers assist underprivileged individuals with car repairs. Various automobile maintenance services are available almost every day of the week except for major holidays. Find out more about CARS Ministry’s services and contact them through their website.

Eligibility Criteria For Churches That Help With Car Payments

There is not enough money in every Churches That Help With Car Payments. They can only serve a limited number of free car repair applicants because their funding comes from nonprofit organizations, volunteers, and their community.

You must fulfill the following eligibility criteria to qualify:

- You must own the car.

- To apply, you must be at least 18 years old.

- Residents of the United States or Canada must apply.

- You should have an active bank account.

- A regular internet connection is required to check your email for application updates.

How To Apply For Churches That Help With Car Payments?

The knowledge that organizations and churches can help you financially is comforting when you’re struggling to make ends meet. The following steps will guide you through the application process for Churches That Help With Car Payments:

- You can find assistance programs at local churches by researching them. Ensure that you meet the eligibility requirements for each program by looking into the type of support it offers.

- Find out how to apply for assistance directly from the Church.

- In Churches, you may need to speak with a counselor or clergy member before completing an application, while in others, you may apply online.

- Gather all the required documents. You may need to provide tax documents, income statements, bills, and other financial paperwork.

- Ensure that the application form is filled out completely and honestly. You will be asked about your current financial situation and why you need church assistance.

- The Church will make a decision after you submit your application. You will receive aid according to the program guidelines if you are approved.

- It may be necessary to reapply for assistance monthly or annually, depending on the specific requirements.

- You can also seek assistance from other local resources and organizations. You can get the support you need during this challenging time by utilizing all available resources.

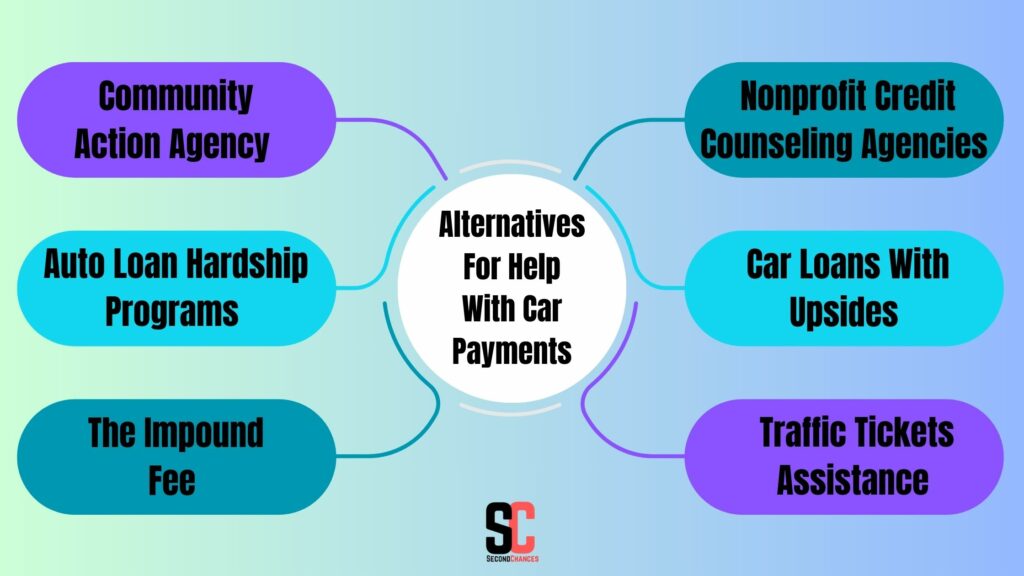

Alternatives For Help With Car Payments

These are platforms for providing car payment assistance to low-income families. Families who own a car and keep it for the sake of improving their lives might benefit from these programs.

Community Action Agency

Community Action Agencies provide a range of services to low-income families. There may be many things they need support with, such as house rent, food, free furniture, and many others. The community action agency is located in every town and county and provides assistance for car payments through grants and other resources. Additionally, they can help seniors, people with disabilities, and families with children obtain low-cost auto loans, hardship programs, and effective transportation services. The platform aims to extend helping hands to those in need.

Nonprofit Credit Counseling Agencies

Credit counseling agencies that specialize in nonprofits may be a great resource for individuals seeking car payment assistance. Although low-income families cannot receive financial assistance directly from this place, it provides counseling and information free of charge. The problem of car payments can be solved by getting advice on how to deal with it. They can also assist with managing low-cost loans and many other services. Additionally, this place may be able to help low-income people get grants and financial assistance. They may receive guidance on negotiating car loans and interest rates as well as other financial plans from the counselor.

Auto Loan Hardship Programs

Those who are struggling with their car payments may benefit from hardship programs. Those who have discontinued car payments due to a financial downturn may be able to apply for this program from lenders. The lender may offer refinancing, late payment waivers, and deferment as part of this policy.

There are some banks, credit unions, dealerships, and lenders that can also relate to the pains and suffering of low-income individuals. Auto loan hardships programs can be used when it is difficult to go through car payment plans effectively. Low-income people may be able to get some assistance on their auto loans through payment plans, and the interest rates for the auto loans may be reduced every month, along with deferment to keep the car.

Car Loans With Upsides

The banks and lenders may help with upside-down car loans in some cases. Traditional borrowers may benefit from this method by getting a lower interest rate and extending car payments. When you’ve established a good relationship with the banks and lenders, you can seek their assistance.

The Impound Fee

Registration issues, traffic tickets, and civil legal matters may cause a vehicle to be seized. The good news is that nonprofit organizations also lend a helping hand to low-income people who can’t afford to pay such fines and expenses. Additionally, nonprofit organizations may be able to assist with payment. In order to get your car back, you must explain that your car has been seized.

Traffic Tickets Assistance

There are many costs associated with breaking traffic laws, including parking tickets, court fines, speeding tickets, and others. Low-income people may be able to obtain cars through charities and nonprofits, as they need a vehicle for their emergency mobility. A law firm that specializes in automobiles can also provide you with legal advice and counseling after you have made a mistake.

When Do I Need To Get My Car Fixed?

It is better to repair your car rather than sell it if there are no major issues with it. A car-related issue can be easily fixed with minor repairs and replacing the faulty parts instead of selling the car and getting a new one.

When you decide whether to repair or sell your car, it’s a matter of simple math, but additional help may be available from Churches That Help With Car Repairs Near Me.

. Your car may need repairs if it exhibits the following symptoms.

- You may have contaminated fuel, dirty air cleaners, or clogged fuel injectors if your car’s acceleration is sluggish or irregular.

- If you are applying them, the brakes may be squealing or screeching, which may indicate worn-out brake pads or rotors.

- An engine that emits more smoke than usual may be consuming too much fuel, lacking timely tuning, or having worn piston rings.

- There is a rattling sound coming from the car, but it is hard to identify the source of the noise.

- Your car won’t start.

- When the car vibrates excessively during driving or when you apply the brakes, it indicates a problem with the tires or a loosening of the engine restraints.

Maintaining Your Car: Steps To Take

Your financial situation may not always be the same. You may have had a better time before losing everything, but now you are faced with a real problem. Car payments are undoubtedly high, and they can cost you a lot of money.

The same may apply to other expenditures as well. You can, therefore, take advantage of car payment assistance programs and other options. Getting car payment assistance is an excellent way to own a car. There are some financial hardship programs available, but assistance may not be available. Among these are refinancing, forbearance, and deferral.

Refinancing

The financial crisis may cause you to fall behind on your payments to the lender, and you cannot see a way to start paying for car payments. The refinancing option may be an option for you in this situation, and this can give you some relief as well.

Refinancing occurs when you search for another loan, but this new loan is the one you want. A refinance means getting loans from a new lender so that the existing loans can be repaid. A new lender may take your car title if you haven’t paid it off after you refinance.

Furthermore, you may also extend the terms of loans, but your monthly payments will be lower as a result. The car may also cost more before you pay off the loan. A lower interest rate loan may increase the total cost, but not too much. This option can be used when you have a good credit score to refinance your loans with more lenient terms.

Seek Financial Assistance

Your lender may be able to provide you with financial support if you default on your loan. Certainly, people may face financial difficulties and have trouble making car payments.

You ask about hardship programs, such as loan deferrals and late fee waivers. A one- or two-month delay payment is possible under the deferral system. You should also be aware that even if you don’t pay interest on the loan extension, interest will accrue.

Some lenders also offer a late fee waiver option. If you ask, your lender may waive the late fee by 30 days, and your credit score will not be affected. The last pandemic has led to some lenders adopting much laxer terms and conditions for car payments.

A Home Equity Loan

If you own a home, you can use it as collateral for home equity loans. The equity in your home may represent 80% of the home equity loan. Depending on your credit score and other financial factors, you may be charged a higher interest rate. If you are planning to take out a home equity loan, you should research it and study it.

Boost Your Income

Due to fluctuating financial situations, people can always have a bad time in any situation. In this situation, it becomes necessary to think of alternative ways of generating income. Also, money can be arranged to protect against financial downturns.

FAQs

Can Churches Help With Car Payments?

There are many Churches That Help With Car Payments. Check out the website to find Churches That Help With Car Payments.

What Churches Help With Car Payments?

There are several Churches That Help With Car Payments, including Lutheran Services, St. Vincent de Paul, Catholic Charities, and Salvation Army.

Who Can Help Me Pay Car Loans?

There are several types of auto loan hardship programs available to you from banks, credit unions, dealerships, and lenders. These are the programs that give you the opportunity to get an auto loan when your financial situation is tough. A low-income family struggling due to overall financial constraints can take advantage of this program by lowering their interest rate, deferring their loans, and other options.

How Long Can You Defer Car Loans?

Those who are considering loan deferral should read the loan deferral policy from their lenders first. Every lender has a different policy regarding car loan deferrals and the duration of the deferral. The majority of it comes in 30 days to 120 days as deferred payments on loans.

Does Car Loan Deferral Affect My Credit Score?

When you want to defer your loan, even if it means you’ll pay a higher interest rate, you need to negotiate with your lender. Your credit score will not be affected if your lender provides you with this scope and approves loan deferral. In any case, it is important to ensure you and your lender are on the same page regarding loan payments.

Conclusion

There are resources available to help you navigate the challenge of car payments. Charities and Churches That Help With Car Payments offer a variety of services, from direct financial assistance to counseling and debt management. Many organizations provide support and relief for those in need, each with its own criteria and process. The organizations listed here can assist you on your journey to financial stability by providing guidance and assistance.