If you’re looking for Houses For Rent No Credit Check No Deposit Near Me, you might have a difficult time. The best rental properties rarely remain on the market for long, especially if renters with stellar credit scores are snapping them up.

There are several things you can do to rent a home or apartment without a credit history.

This article examines the top Houses For Rent No Credit Check No Deposit Near Me, how they work, and many other topics.

Let’s get started right away.

Table of Contents

Why is A Credit Check Required To Rent An Apartment?

Whether a prospective tenant is capable of making timely rent payments will be determined by a credit and background check. These measures do not reveal the full story of a person’s finances, but they are commonly used to assess liability and protect property owners.

The owner may check your credit report for things like prior bankruptcies or evictions, as well as late payments. A history of debt collection or large debts may also raise red flags.

Can You Rent An Apartment With No Credit Check?

There are no credit check apartments available for rent, regardless of your credit score. Also, if you don’t want to provide your credit score, these apartments are an option. You may have a difficult time finding Houses For Rent No Credit Check No Deposit Near Me.

How To Find A Private Landlord Without A Credit Check Near You?

There are ways to find a private landlord who doesn’t perform credit checks, including the following steps. These can all be done by the tenant, are free to perform, and can be another option.

The Apartment Website

The online real estate marketplace Zillow and HotPads allow users to search for properties based on various criteria and reach out to local landlords. Among its features is the ability to search for “income-restricted” apartments, and it also allows borrowers to search for houses that do not require a credit check or bad credit.

Markets, Classifieds, And Apps For Locals

There are often Houses For Rent No Credit Check No Deposit on websites or apps, such as Facebook Marketplace, by private apartment landlords, some of whom may not require a credit check.

Brokerages For Apartment Communities

The requirements of private landlords can be flexible, and some real estate agents and brokers work with them. You might be able to find a landlord who doesn’t require a credit check through them.

Providers of No-Credit-Check Housing

There are often organizations, including community action agencies, that can provide information about private landlords near you who accept tenants with a flexible or minimal screening process, who do not require credit checks or application fees, and who offer other services.

It’s important to remember that a landlord is likely to still want to verify your ability to pay rent, even if they don’t require a credit check. The process may involve checking the status of your employment, salary, rental history, and personal references.

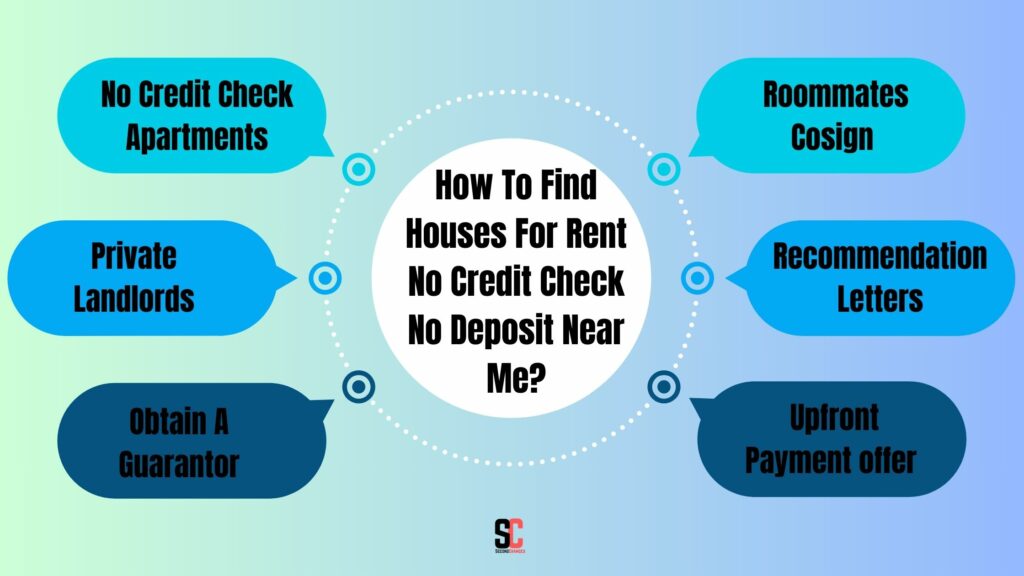

How To Find Houses For Rent No Credit Check No Deposit Near Me?

Here are seven tips to help you find Houses For Rent No Credit Check No Deposit if you want to increase your chances of approval.

No Credit Check Apartments

You can search for an apartment that doesn’t pull your credit before considering your application by entering a search term such as “Houses For Rent No Credit Check No Deposit.” The chances of your apartment application being approved are higher if it does not require a credit check.

Renters may be lured into substandard apartments by landlords looking to extract high fees through not requiring a credit check. A careful reading of the lease agreement is required to understand the payment terms and safety concerns of the apartment.

Private Landlords

A private landlord has more freedom to negotiate than a large property management company. Private landlords may be willing to answer questions about your finances and your suitability as a tenant even though you have no credit history when you meet with them for an apartment tour or application.

These apartments are often in buildings like duplexes or basement-style apartments in townhouses, which can be found through word-of-mouth. Keep an eye out in your neighborhood for “For Rent” signs, and ask family and friends to keep an eye out.

Obtain A Guarantor

In case you are having trouble finding an apartment without credit, a guarantor could be able to help. A guarantor is also someone who signs your lease, claiming responsibility if you fail to pay rent. However, they do not have any right to live on the property.

The first person to consider when looking for a guarantor is a friend or family member over the age of 21 with good credit. The service can act as a guarantor if you can’t find anyone who can serve as your guarantor. The fees will range from 4% to 10%, and you will need to read the contract carefully so that you understand all limitations and costs.

Roommates Cosign

It may be possible to rent an apartment with roommates who have good credit scores, similar to getting a guarantor. All of you will sign the lease and rent payments.

The credit score is only one aspect of the search for roommates: It’s also important to ensure they have a steady income that will allow them to pay their rent on time every month. The key to finding a financially stable roommate is finding one who pays rent and other bills as well.

Recommendation Letters

When there is no one available to act as a cosigner or guarantor, see if there is someone who can write a letter of recommendation for you.

This person should have some knowledge of your personal finance history and be able to discuss your future financial prospects with you. Another good option is to talk to an employer about the likelihood of your continued employment. A former landlord can vouch for your responsibility to pay your rent on time.

Upfront Payment offer

It may be necessary to resort to some cold, hard cash when all else fails to ease a landlord’s concerns that your lack of a credit score may indicate a risk; pay more upfront if possible. A cash deposit of one extra month can be added to the first, last, and security deposits.

Additionally, offering to pay a large portion of the lease term in cash ahead of time might help you save on your rent. Still, these negotiations will depend on your landlord’s flexibility and your ability to pay.

How To Build A Good Credit Score?

It doesn’t hurt to build your credit if you aren’t moving soon or if you’re having trouble getting an apartment.

- The user must put down a cash deposit when opening the account. Putting down $250 will equal the credit limit on the card, so if you put down $250, then that’s your limit, too. You can upgrade from a secured to an unsecured card without putting down a deposit.

- Your utilization will likely decrease, and your score will likely be built as a result since you won’t need to make payments. A responsible credit user is a good source of information.

- A credit-building loan can help you build your credit. You make payments over time to the lender, usually a credit union or small bank. You receive the lump sum when you have repaid the loan in full. The benefit of this type of loan is that you will build a history of on-time payments while accruing funds for an emergency or other purpose.

- You can get credit for rent and utility payments. Your credit reports can reflect your rent payments if you use a rent-reporting service. Making sure you pay all your bills on time is the key to acquiring credit and building a good credit score.

Do Private Landlords Do Credit Checks?

It is common for private landlords not to perform credit checks, although it varies from landlord to landlord. The best option if you want a no-credit-check apartment is to find a private landlord. The landlord may still allow you to sign a lease if he or she convinces you that you will be a good tenant who pays rent on time.

Pros And Cons of Houses For Rent No Credit Check No Deposit Near Me

The cost of renting a home can be less than the cost of buying one for many Americans. The following are just a few of the advantages and disadvantages of renting a house.

Pros

- Many Americans may find comfort in knowing that their mortgage payment is contributing to homeownership. However, any repairs or upkeep will be the responsibility of the owner. The possibility of extensive, costly maintenance can lead people to choose renting over mowing the lawn, pressure washing the driveway, and planting a garden. You can enjoy living in a home as a renter without worrying that a multi-thousand-dollar repair may be lurking around every corner.

- You pay your interest fees as part of your monthly mortgage payments when you purchase a home. You can usually get a lower interest rate if you have a better financial history, a higher credit score, and a larger down payment. This may lead to borrowers with a checkered past being penalized and facing higher interest rates. The same borrowers may be perfectly comfortable renting a home, resulting in a lower monthly mortgage payment than if they had purchased.

- Tenants typically pay the security deposit and the first month’s rent, but these expenses pale in comparison to a home’s pre-purchase expenses. A home loan can cost you tens of thousands of dollars before you’ve made your first mortgage payment due to down payments, closing costs, and administrative fees. There are numerous hidden costs associated with buying a home that go far beyond these expenses. The difference between appraised and market value is not a concern when you rent.

- You may not be able to buy a home right now, but renting can be a temporary solution while you prepare to become a homeowner. The terms of a lease vary from situation to situation, but renting means you won’t be stuck in one place too long. Furthermore, renters are not obligated to pay dues to a homeowner’s association (HOA), another advantage of renting. A homeowner’s growing list of expenses can include membership dues and other fees.

Cons

- One of the most exciting aspects of home ownership is customizing your home, and more than half of all new home buyers intend to do so. It’s easy to make your mark on your new house and boost its value and, therefore, your home equity while also making your new house feel more like home. When you sign a rental lease, you are bound by the terms and conditions of the agreement. A dated interior, unappealing paint color, and existing amenities are likely to continue. It’s possible that you might see an increase in your rent when it comes time to renew if you make value-adding changes.

- The more you make on-time mortgage payments, the more your credit will improve. In contrast, on-time rent payment provides little more than a roof over your head and keeps your landlord happy. You can leverage the monthly rent payments you make as a tenant to increase your credit score. You can boost your credit as a renter by self-reporting your good payment history for a nominal fee.

- The fact that you put pen to paper on a home purchase contract is effectively a guarantee that your current interest rate will not change; if it were to change via a refinance, borrowers stand to benefit. A lease can vary depending on the housing market, and unscrupulous landlords may force tenants out. There are some states that have legislation to prevent excessive rent increases, but for the most part, anything goes.

- A main disadvantage of renting a home is that it doesn’t earn you equity. It goes directly to your landlord’s pocket or earns them equity. Therefore, many renters will want to put their dollars to good use by buying a home. However, if you consider the cost of repairs and the many responsibilities that come with home ownership, you may find that renting actually makes more sense than owning.

FAQs

What Are Houses For Rent No Credit Check No Deposit Near Me

A credit check is not required to rent an apartment without a no-credit check policy. The process differs from traditional rental screening, during which landlords check your credit to see if you can make payments on time.

What Credit Score Do You Need For Most Apartments?

According to Rent Cafe’s study from 2020, the average credit score for renters was 638. You are most likely to find an apartment to rent if you have a score of 650 or higher in many places. The good news is that most landlords will not reject tenants based on their credit scores alone.

Why Do Landlords Perform Credit Checks?

Landlords use credit checks to ensure prospective tenants will fulfill their duties as good tenants by paying their rent on time and caring for the property.

Can I Rent an Apartment With No Credit Score?

There is no credit score requirement for renting an apartment. The search may need to be narrowed to apartments with no credit checks, for-rent-by-owner apartments, month-to-month leases, or apartments with a higher security deposit.

Is it Harder To Get A Loan For A Rental Property?

Yes, rental properties generally require a more complicated loan process than primary residences. Due to the increased risk associated with rental properties, lenders typically require a larger down payment and a higher credit score and may charge higher interest rates.

How Can I Invest in Property With No Money?

You can invest in property with minimal funds by using strategies such as house hacking, in which you live in part of the property and rent out the rest, or by partnering with other investors. A government-backed loan program or seller financing are other options. It’s possible to invest in real estate with no money down if you know how.

Conclusion

Although Houses For Rent No Credit Check No Deposit Near Me can be difficult, it is certainly possible. Apartments without credit checks may be available from private landlords, as they may be more accommodating of credit histories. Additionally, if you’re facing financial difficulties and need assistance with rent, consider reaching out to churches that help with rent assistance near you.Additionally, you can show proof of sufficient income, assets, or savings by asking someone with good credit to cosign for you, finding a roommate with good credit, or offering to pay more of your expenses upfront.