What are Low Income Apartments in the US with Second Chances? How do they work? How can low-income apartments for needy people be obtained? Here, we will answer all your questions.

A decent, safe, and comfortable home is essential for the well-being of every individual. Safe shelter is essential to healthy living for individuals and families in all types of communities, from suburban areas to small towns to urban areas.

A large number of American families and individuals are unable to access secure and stable housing because of a variety of reasons.

To help people with low incomes, the federal government and nonprofit organizations have designed grants and programs.

The given guide will provide you with all the information regarding Low Income Apartments in the US with Second Chances.

So, let’s get started.

Table of Contents

What Are Second Chance Apartments?

The second chance apartment, also referred to as transitional housing or reentry housing, is a type of residential unit designed for individuals who may have had difficulties securing housing due to past credit issues or criminal records.

The apartments provide tenants with a chance to rebuild their lives and improve their financial situations to reestablish a stable living environment.

Importance of Low Income Apartments in the US with Second Chances

Second chance housing reduces homelessness by providing housing opportunities to those with barriers to renting. People become self-sufficient and contribute positively to society when they have a home to call their own.

- The second chance housing concept promotes inclusion by offering equal opportunities to everyone, regardless of their past. Various challenges may result in stigmas associated with these programs, but they foster a sense of community and help break down those stigmas.

- A stable home is a critical step in the rehabilitation process for those with criminal records. It can be beneficial to prevent recidivism and promote reintegration into society when a residence is safe and stable.

- Second chance housing contributes to local economies indirectly by providing housing for those who would otherwise face housing challenges. The programs generate revenue and support businesses by creating demand for goods and services.

Is Second Chance Housing Legit?

The importance of second chance housing programs in our communities cannot be overstated. The programs cater to people with bad credit, prior evictions, or criminal records and are a valuable lifeline for many. Furthermore, second chance housing programs contribute to the reduction of homelessness, the promotion of rehabilitation, and local economic growth.

How To Find Low Income Apartments in the US with Second Chances?

Housing Authorities

You can find second chance housing resources and programs through your local housing authority.

Search Online

Low Income Apartments in the US with Second Chances can be found using websites like ApartmentFinder, ForRent, and Zillow. You should apply filters to include properties that are available to people with challenging rental histories.

A Social Service Agency

There are often second chance housing programs connected to social service agencies, non-profit organizations, and local charities, which can assist you in finding the right program.

Word of Mouth

Describe your needs and share your story with friends, family, and acquaintances. You may be able to find Low Income Apartments in the US with Second Chances through them, or they might be able to connect you with someone who is.

Be Persistent

Make sure you remain committed to your search and remember to put in the time and effort necessary to find the right Low Income Apartments in the US with Second Chances.

Eligibility Criteria For Low Income Apartments in the US with Second Chances

The purpose of second-chance apartments is typically to provide housing options for persons with lower credit scores or less-than-ideal rental histories. The following are some general eligibility criteria that an applicant may need to meet regardless of the apartment complex’s policies:

- Many Second Chance apartments conduct criminal background checks. Criminal records do not automatically disqualify you; however, certain types of convictions or recent offenses could do so.

- The application often asks for information about the applicant’s rental history, including previous landlords and references. A poor rental history may be one of the reasons you need a second chance apartment, but some apartments may require proof that you have attempted to resolve past rental problems.

- There may be more leniency toward credit scores in second chance apartments compared to traditional apartments. There are some lenders who will accept applicants with lower credit scores or offer alternatives to demonstrate financial responsibility, such as proof of income or a co-signor.

- It is usually necessary for applicants to demonstrate a steady source of income to cover their rent in order to apply for an apartment. Generally, the income threshold ensures the renter can afford the monthly payments.

- The application fee covers the processing and background checks associated with your rental application.

- Your application may benefit from an explanation of any past rental issues or credit problems. It is beneficial to demonstrate your active efforts to improve your situation.

- A pay stub or employment verification can strengthen your application and demonstrate your ability to pay rent.

- There are Low Income Apartments in the US with Second Chances that may ask for character references from individuals who can vouch for your dependability and trustworthiness.

- Make sure you carefully read the rental agreement. You should be aware of the lease duration, the rent amount, and security deposit requirements.

A Low Income Apartments in the US with Second Chances eligibility criteria may vary from one complex to another, so it is important to inquire about specific requirements and policies with specific apartment complexes.

Application Procedure For Low Income Apartments In The US With Second Chances

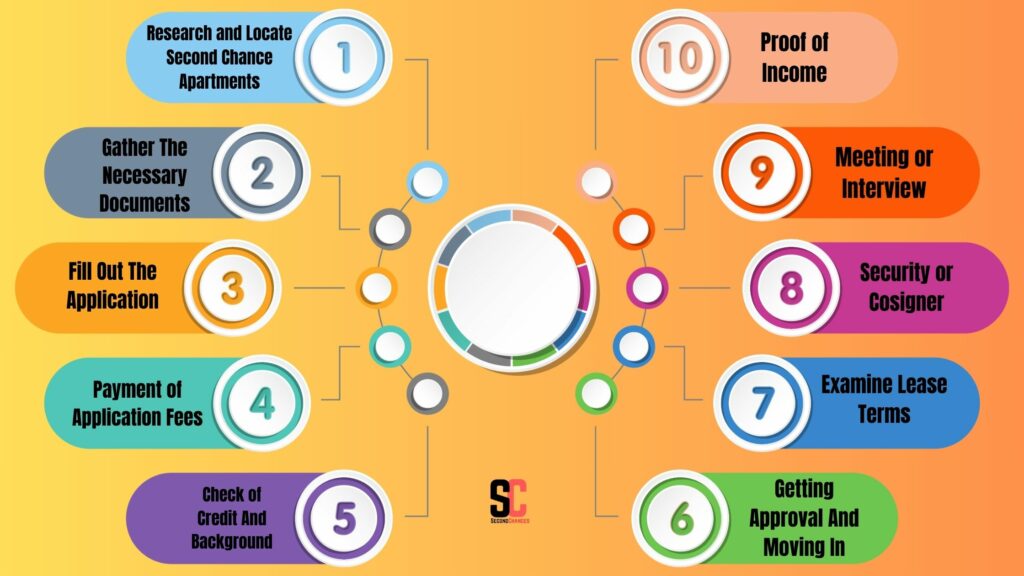

The second chance apartment application process aims to help individuals with less-than-perfect rental histories or credit ratings secure housing. The typical steps are as follows:

Research and Locate Second Chance Apartments

The first step is to identify apartment complexes or property management companies that offer second chance leasing programs. A local housing agency or online search can help you find them.

Gather The Necessary Documents

Your application needs to be supported by the following documents. A letter of recommendation and references are typically required, as well as proof of income and identification (such as a driver’s license or ID card). Honesty is the best policy when it comes to your rental history.

Fill Out The Application

The property management will provide you with an apartment application. You should provide accurate and thorough information about your rental history, employment, and personal information.

Payment of Application Fees

An application fee is usually required for most apartment applications. Applicants should be prepared to pay this fee so that their application can be processed.

Check of Credit And Background

The property management company will conduct a background check and a credit check. You are still expected to guarantee that you will be able to meet your rental obligations, even if you have poor credit.

Proof of Income

You may need to provide proof of income, such as pay stubs, bank statements, or tax returns. You need to prove that you have a stable income source for property management.

Meeting or Interview

A virtual or in-person interview may be required to discuss your rental history and commitment to responsible tenancy at some second chance apartments near Me.

Security or Cosigner

The property management may require a cosigner or a larger security deposit to mitigate potential risks associated with your application.

Examine Lease Terms

Pay close attention to any provisions or conditions about second chance leasing in the lease agreement.

Getting Approval And Moving In

As soon as your application has been approved for Low Income Apartments In The US With Second Chances, you can sign a lease and prepare to move into your new apartment. In order to maintain your good standing as a tenant, make sure you pay any required deposits and rent on time.

The purpose of second chance apartments is to provide housing opportunities for individuals with imperfect rental histories. You can improve your chances of approval by being honest and transparent during the application process.

Why Low Income Apartments In The US With Second Chances Applications Are Turned Down?

It’s important to understand why your application for Low Income Apartments In The US With Second Chances was rejected. The denial of an application is not personal. A portion of your application may not meet the qualifying criteria, you may not have completed the entire application, or references may not have been verified.

The reasons for your apartment application being denied a second time are as follows.

The Lack of Affordability

When you submit your paperwork, your landlord or property manager will determine whether you are affordable. It includes verifying gross monthly income and net monthly income and considering rent and general expenses. In addition, overtime may not always be included in your income since overtime is not always guaranteed. Your application will be rejected if they determine that you are not affordable.

A Lack of Paperwork

When filling out your application form, it is very easy to miss something. A high demand for a specific apartment may result in your application being overlooked if you do not fill out the necessary paperwork, even though your next competitor has a fully completed, referenced, and updated application. Your apartment application may be denied as a result.

References Updated

The importance of references in apartment applications cannot be overstated. An apartment application can be greatly enhanced with references from your current and former employers, your former landlord, or a professional recommendation.

You can help a landlord determine whether you will be a quality tenant by providing references that reflect your reliability, responsibility, and positive characteristics.

Documentation Support

To show the landlord that you are taking steps to address negative credit, attach your bank statement to your application. A landlord may also request references, proof of income, and documents to support your application.

False Information

You should ensure that the information you provide is accurate and up-to-date before applying for an apartment. Application for an apartment will be automatically denied if the details are outdated, incorrect, or falsified. There is a need to verify second chance apartment applications. The information you provide about yourself and your place of employment will be verified. Credit checks and background checks will also reveal inaccurate information.

Why More Landlords Should Offer Second Chance Housing?

A landlord’s efforts can make a significant social impact by providing affordable housing for those in need, contributing to the creation of an inclusive and supportive community.

Second chance housing creates demand for goods and services, which indirectly benefits the local economy. A result of this can be the creation of jobs and an increase in revenue for local businesses.

Low Income Apartments In The US With Second Chances can help reduce recidivism and support reintegration into society for individuals with criminal records.

Landlords can benefit from offering second chance housing to gain a positive reputation in the community, which can lead to more tenants and potential partnerships with social service agencies.

How To Deal With A Denied Second Chance Application?

There is nothing personal about a denial of an apartment application. There are certain tenancy requirements to meet. The Second Chance Apartments evaluates each application individually. The reason for your application denial may not be as specific as others since each application is evaluated on its own merit.

Government Assistance Programs That Provide Low Income Apartments

A low-income apartment can be described under different names, such as income-based housing, section 8 housing choice vouchers, public housing, project-based Section 8 rental assistance, or section 202 supportive housing for the elderly. These are all definitions of low-income apartments, which are all about low income. Low-income apartments require applicants to meet a defined income limit according to the area.

Housing Choice Voucher (Section 8)

There are several low-income apartment programs that offer housing choice vouchers or Section 8 vouchers. Your income, family composition, and local housing costs determine the amount of the voucher. Low-income families can afford to live in safe, decent, and healthy housing through this program.

The Public Housing agencies administer these programs for qualified families, but the Department of Urban Development funds them. This program is available to families earning less than 50% of the area’s median income. The percentage may vary depending on the city and state income guidelines.

The housing choice voucher covers the rest of the monthly rent. A Section 8 housing choice voucher allows participants to rent an apartment, townhouse, or single-family home. The apartment must meet safety and health standards. It is also the landlord’s responsibility to make sure these housing choice vouchers are available to low-income households.

Public Housing

The public housing program is another government initiative that identifies housing projects. A government-funded housing project provides low-income housing for the elderly and those with low incomes. This can be an option for those who don’t qualify for housing choice vouchers.

Your gross annual income will determine the amount of your rent. This will be determined using 30% of their adjusted monthly income. The public housing authorities have guidelines for fixing up rent by $25 to $50. The low-income housing market includes apartments, townhouses, and single-family homes. Your current or past landlords may be contacted by the housing authority to determine your eligibility for low-income apartments. Additionally, they may check your current rental home to make sure you are eligible.

Project-Based Section 8 Rental Assistance

A project-based Section 8 rental assistance program is another great way to ensure low-income housing. This program aids landlords in providing low-income apartments to low-income people by providing them with low-income apartments. A public housing authority (PHA) manages this program with government subsidies.

The program is designed to provide low-income households with affordable apartments where private landlords receive rental subsidies. An adjusted income of 30% or 10% of gross income is required. A project-based Section 8 rental assistance program is the same as a Section 8 housing choice voucher, which is only available to U.S. citizens.

Section 202 Supportive Housing

The Section 202 supportive housing program is for the elderly and senior citizens. They must have a low income since they don’t work hard for old age. Their incomes are lower than those of young people. This program provides subsidies to private landlords or apartment communities to ensure that more low-income apartments are available for the elderly and senior citizens. As part of this program, seniors or the elderly must pay 30% of their net income, and the housing program pays the remainder. Seniors or the elderly must be 62 years old to qualify for this program.

Section 811 Disabled Apartments

There is no separation between disabled people and the community. They also have the right to live in a decent place, even if they do not have income due to disability. The program provides subsidized apartments for people with disabilities. A 30% increase in net income and a 10% increase in gross income determines the rent amount.

People with disabilities may apply to a property management company or landlord under section 811. Applicants are assessed and selected based on their income level, disability status, and living conditions.

FAQs

Are Low Income Apartments In The US With Second Chances available in All Areas?

The availability of Low Income Apartments In The US With Second Chances can vary depending on the region and local housing market.

As second chances become more widely recognized, more communities are becoming committed to providing them and working to expand them.

What States Have The Best low Income Housing?

There were over 35 subsidized units per 1,000 people in Rhode Island in 2022, the highest number per 100,000 people. The next five are New York (30), Massachusetts (28), Connecticut (23), and Louisiana (21).

What is The Most Section 8 Will Pay?

A family’s maximum housing assistance is usually equal to the payment standard minus 30% of their monthly adjusted income or the gross rent.

Conclusion

Low income apartments In The US With Second Chances or Homes offer hope and opportunity for those who are not able to access traditional rental options. The programs play a critical role in reducing homelessness, encouraging inclusion, and encouraging rehabilitation. Those with challenging rental histories can work towards a brighter future if they seek out these opportunities actively and remain persistent.