Are you looking for Online Colleges That Offer Financial Aid without any complicated paperwork? If Yes, you’re on the right page.

A remote learning program gives busy college students the opportunity to take courses on a college campus when they can’t physically attend those courses. This alternative method of earning a degree can be just as costly as in-person study, but it’s convenient.

Online colleges offer financial aid to those who don’t have thousands of dollars saved up to finish their degrees. The following guide will give you a thorough overview of Online Colleges That Offer Financial Aid.

Here we go.

Table of Contents

What Is An Online College?

An online college that awards degrees is known as an online college. Generally, there are two types:

- A non-profit institution that offers some online degrees as well as brick-and-mortar campuses

- A for-profit institution that focuses primarily on online education

A for-profit college or university has national accreditation, while a non-profit school has regional accreditation. The FAFSA should be available when you attend either, but transferring credits from a national to a regional institution may present greater restrictions.

How Does Online College Work?

The most common question people ask about online colleges is, “How do they work, anyway? ”

The main function of an online college is to offer accredited degree programs through a completely distance learning environment. These schools offer online classes covering the same course materials in a virtual setting rather than requiring students to attend classes on campus. As a result, students can earn credit hours toward their degree while working from the comfort of their own homes.

Today’s students have many reasons to choose online, especially those who work, have families or have other commitments that prevent them from attending classes on campus.

What Is Online Colleges That Offer Financial Aid?

A financial aid package is a sum of money given to students from external sources to help them pay for college. The funds are typically used to cover living expenses, tuition fees, college books, supplies, and other costs. Financial aid programs are available for families of any income level, regardless of their financial status.

It is vital to understand that some forms of financial aid are provided by beneficiaries and must be repaid.

Does Financial Aid Cover Online Schools?

Financial aid may be available for some online schools, but not all. Online schools must adhere to a variety of requirements under the Department of Education’s Title IV program. Firstly, your school needs to be accredited by a primary accrediting agency.

Federal Student Aid (FSA), the federal agency that distributes financial aid, also requires Title IV schools to undergo regular audits and program reviews.

An online school that is a Title IV school accepts the FAFSA and can accept and administer financial aid.

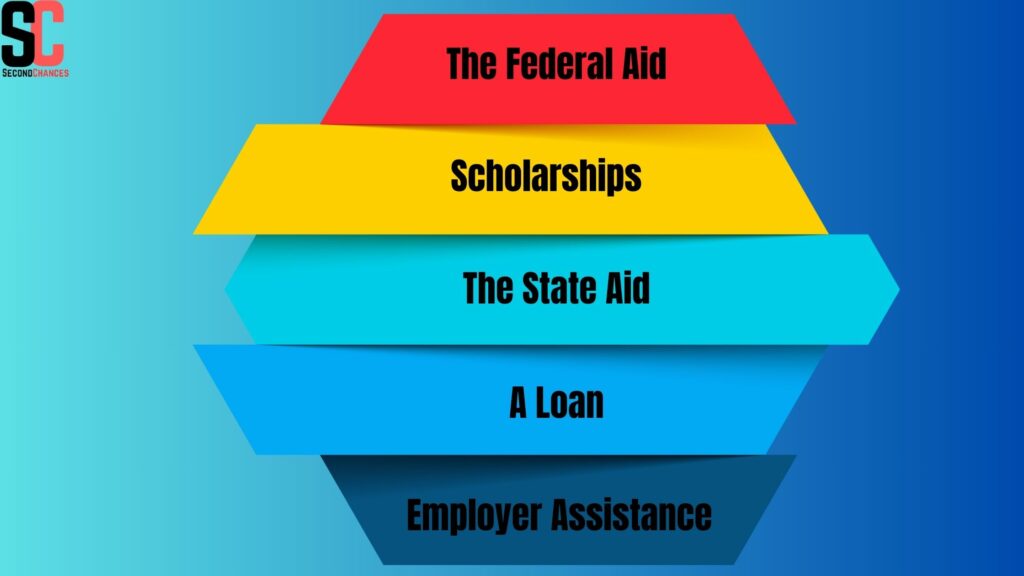

5 Types of Financial Aid For Online College

An online college degree requires a significant investment of time and money. There are a number of financial aid options available. See how you can fund your education while cutting costs.

The Federal Aid

The federal government is able to provide grants and loans to students who are in need of financial assistance. The federal government does not require repayment of grants. It is, however, important that you maintain a good academic standing. There is a maximum award amount of $6,895 for Federal Pell Grants for the 2022-23 academic year.

Additionally, federal loans are available to help you pay for college. It is not until students graduate that subsidized loans accrue interest. The federal financial aid program is open to U.S. citizens and eligible noncitizens.

The State Aid

The state government also provides grants and loans. Additionally, states may provide tuition-free community colleges or merit-based scholarships using lottery revenue. For example, the South Carolina Education Lottery Second Chance offers additional opportunities for students to fund their education through winnings and scholarships. There are different eligibility requirements in each state.

Scholarships

The availability of scholarships can be a crucial source of financial assistance for college students, particularly those who are struggling to pay tuition and other school-related costs.

A Loan

Several students require student loans to cover tuition, fees, educational costs, and living expenses. Despite the fact that students must pay back loans, and interest accumulates over time, this financial aid option allows students without the means to pay for school to gain access to higher education.

Employer Assistance

The employer assistance program provides tuition support to employees who are pursuing higher education. The types of financial aid offered by employers can vary but can include tuition reimbursement programs and scholarships. The purpose of these programs is not only to help students pursue their degrees but also to help employers who prioritize higher education as well.

Who Is Eligible For Online Colleges That Offer Financial Aid?

There are specific requirements for candidates to qualify for Online Colleges That Offer Financial Aid. These are the primary eligibility criteria:

- You must have a valid Social Security number to apply.

- The candidate must be enrolled in an eligible certificate or degree program as a regular student.

- A valid proof of financial need for students.

- The applicant must be a US citizen or a legal non-citizen.

- The applicant must be admitted to at least a part-time program.

- To be eligible for higher or college education, students must possess a GED or high school diploma.

- Maintain an exceptional academic record in training (career) schools or colleges.

- The Free Application for Federal Student Aid (FAFSA) requires that you sign and complete the Statement of Certification.

- The use of financial aid must be limited to educational purposes only.

- There must not already be a federal student loan or grant owed to the applicant.

How To Apply For Online Colleges That Offer Financial Aid?

The FAFSA is the first step in applying for federal financial aid to pay for your online school tuition.

Organize Documents

There are several types of documents you may need, depending on your circumstances. The following information is generally required for you (and your parents if you are a dependent):

- A Social Security number or an Alien Registration number

- Driver’s license number

- Recent tax returns and tax documents

- Other relevant financial records

Establish An FSA ID

You and your parents each need to create your federal student aid (FSA) ID accounts online. Your FAFSA will be completed, and your student aid account will be managed here. Additionally, you will sign your master promissory note there if you are receiving federal student loans and have completed the loan counseling process.

Submit Your FAFSA

The FAFSA is available online or as a PDF download. The application process requires you to provide information about your dependency status, demographics, financial situation, and the schools to which you would like your FAFSA sent.

Your application can be submitted as early as October 1 of the upcoming academic year. Before sending it, make sure you and your parents have signed the FAFSA.

The deadline for submitting the FAFSA for the academic year is June 30. However, some states and schools will have their own deadlines. Ensure you complete your FAFSA before these deadlines, as some types of aid are granted on a first-come, first-served basis.

Check Your Student Aid Report

A Student Aid Report (SAR) will be sent to you after you complete the FAFSA. The SAR summarizes the information you submitted on the FAFSA. You should verify that all of the information on your FAFSA is accurate, and you should make corrections if you find any errors.

Get Federal Student Aid

In the event you are eligible for federal financial aid, your online school’s administrator or financial aid office will provide you with next steps. The aid you wish to move forward with must be accepted, and additional paperwork may be required.

You must sign your master promissory note and enter loan entrance counseling before you can pay your tuition and fees out of your student loans.

Top Online Colleges That Offer Financial Aid

A number of Online Colleges That Offer Financial Aid are listed below. They are some popular federally funded schools and their average tuition costs as of 2024:

American Public University

The university offers more than 200 online courses for undergraduate and graduate students. Courses start monthly and last eight to 16 weeks. The university enrolls more than 48,000 students, who pay an average tuition of approximately $6,800.

University of Florida

The University of Florida is based in Gainesville, Florida. A well-rated online division also offers bachelor’s degrees in 24 fields, master’s degrees, doctorates, and certificates online. Student tuition averages $4,477 for in-state students and $25,694 for out-of-state students.

University of Phoenix

The University of Phoenix offers online bachelor’s and master’s degrees at a tuition cost of $9,552. It offers academic advisers, career services, virtual job fairs, and internship opportunities to online students.

Purdue University Global

Purdue University has almost 38,000 students enrolled in its 33 online bachelor’s programs and 29 online master’s programs. A public university such as Purdue offers cheaper tuition rates to Indiana residents compared to out-of-state universities, with in-state tuition averaging $7,920 and out-of-state tuition averaging $13,356.

Southern New Hampshire University

SNHU offers more than 200 online programs in areas such as art, education, engineering, healthcare, and business, in addition to in-person courses. Approximately 134,000 students attend this university, where tuition averages $9,600.

Walden University

Walden University offers remote undergraduate and graduate programs. Additionally, it offers virtual job fairs and internship programs to support online students. The average tuition is $10,428.

Western Governors University

The university offers 30 bachelor’s degrees and 29 master’s degrees online. In addition to its online programs, it provides students with career services professionals, academic advisors, and virtual job fairs. The average tuition cost for its 136,000 students is $6,380.

Online Colleges That Offer Financial Aid Ethics

If you’re still undecided about Online Colleges That Offer Financial Aid, take a look at the primary function of the Office of Financial Assistance:

The goal is to provide students with adequate financial resources so they can reach their academic potential.

This statement was adopted by the National Association of Student Financial Aid Administrators as a guideline for conduct in the financial advisor’s office. The ethics are as follows:

- Help students with financial needs as soon as possible

- Keep a high ethical standard and avoid conflicts of interest

- The profession should encourage freedom of expression, opinions, and ideas and respect for different points of view

- Ensure that services are provided without discrimination based on gender, race, religion, economic status, or age

- Students’ privacy and confidentiality are respected, as well as personal information and student records are kept confidential

- Assist students and their families with accurate educational information

- Educate yourself on student issues and advocate for their rights at the state and federal levels

Online Colleges That Offer Financial Aid Scams – Steps To Protect Yourself

Unfortunately, there are financial aid scams out there. You can reduce your risk of experiencing a scam by being well-informed. The following are some tips for avoiding student aid fraud:

Never Pay An Advance Fee

You shouldn’t pay someone to get your student loan debts repaid. There are many debt relief services that debt relief companies offer that you can perform on your own. If you are seeking assistance from a reputable company, they won’t demand payment in advance.

Protect Sensitive Personal Information

The risk of identity theft increases when unwelcome individuals have access to your information. You should always be vigilant when giving out personal information over the phone or the internet. You should know who has access to your data and verify the legitimacy of your sources before providing them with your credit card information.

Beware of Companies Making False Legal Claims

Several scams exploit the trust placed in business professionals. A debt relief company or law firm cannot guarantee that you will have lower student loan payments by negotiating on your behalf. If you are searching for the best financial aid offers, proceed with caution. Often, fake schemes use clever emails filled with practical terms to lure students into giving them money.

Benefits of Online Colleges That Offer Financial Aid

There are benefits to education at any level. A BLS report indicates that associate degree holders earn $157 more a week than high school graduates. A bachelor’s degree increases that figure to $524 per week. The BLS tracks around half of occupations that require an academic degree, which may provide you with more job opportunities.

Additionally, there are many advantages to attending an online college:

Lower Overall Costs

Online colleges often have lower costs than in-person institutions, especially since you don’t have to commute to class. The total cost of an online bachelor’s degree will range from $38,496 to $60,593 [7], depending on the institution and program. A typical in-state public college’s tuition and room and board costs are $103,456 [8].

Flexible Scheduling And Learning Environments

There are two main types of online classes: synchronous classes (where you and your classmates meet with your instructor at a specified time) and asynchronous classes (where you work on lessons and assignments individually without meeting with your instructor).

You can decide where to study, wherever is most convenient for you. Also, online classes are more flexible than in-person classes, which is helpful if you want to continue working while attending school.

Develop Transferrable Skills

An online college degree often requires more time management and self-discipline than in-person courses since you are responsible for studying, learning, and completing assignments. Although online colleges aren’t for everyone due to their demands, they can help you develop transferrable skills, such as working independently, that employers value.

Other Ways To Learn Online

You can enhance your educational credentials and gain a deeper understanding of a specific subject without having to enroll in a longer degree program. Here are a few to consider.

Certificate Programs

The number of colleges and universities offering certificate programs in a variety of fields is growing, including copyediting, commercial property management, financial planning, and more. A certificate program can help you build job-ready skills in five to seven months.

Training Camps

If you’re looking for a more in-depth, but ultimately shorter, way into a subject, bootcamps may be a good choice. You can gain job-ready skills in areas like computer science, data science, and user experience with these courses. You can accelerate your learning process by completing boot camps in a concentrated amount of time.

The Courses

You can take independent courses from a number of renowned university partners without enrolling in a full degree program. Take a Statistics course at Stanford University, a Financial Markets course at Yale University, or a UX course at Georgia Tech and gain an understanding of user experience design.

FAQs About Online Colleges That Offer Financial Aid

What Financial Aid Options Are Available To Online Students?

There is financial aid available for online learners. There are several federal financial aid options available to students, including loans, grants, and scholarships that help pay for tuition and living expenses.

Does The FAFSA Cover Online Certificate Programs?

There are various online certificate programs offered by accredited colleges and universities that can be covered by FAFSA. In some cases, online certificate students can qualify for federal financial aid, including loans and Pell Grants.

Can A Pell Grant Be Used For Online Classes?

There are Pell Grants available for online and on-campus programs. These funds are not repaid for your online degree. The federal government permits you to receive Pell Grants for six years or 12 terms.

Can I Transfer My Financial Aid From Another Institution To An Online College?

A student’s financial aid cannot always be transferred between colleges. Make sure your new school can give you financial aid, and if you need to withdraw or cancel your payments, ask them.

Additionally, you’ll need to update your FAFSA. It is important to keep in mind that transferring to another school can affect your financial aid. You will receive financial aid based on tuition costs and the transfer date. This may also put your loans into repayment.

What Does The EFC Score Mean?

EFC scores are based on information submitted in FAFSA applications. The score computed determines a student’s eligibility for financial assistance.

How Much Financial Aid Can I Get Per Semester?

Colleges and institutions receive a wide range of aid. A student can expect to receive between $650 and $6400 per year. Financial assistance is split 50/50 between the winter and fall semesters.

How Much Money Can A Student Have Before It Impacts Financial Aid?

A student’s income before it affects their financial aid varies. Student income between $6570 and $6600 is considered income, affecting financial aid eligibility.

Will My Savings Account Affect My Financial Aid?

Keeping money in a brokerage account or traditional savings account can reduce your eligibility for financial aid. Educational savings accounts (ESAs) and 529 plans will have a minor impact.

Conclusion

You now have a deeper understanding of Online Colleges That Offer Financial Aid.

The next step is to apply the strategies you learned in this article to your subsequent student aid applications. One valuable resource to consider is the California Dream For All Program, which provides financial support to eligible students pursuing higher education in California.