Second Chance Banking With Overdraft Protection depends heavily on your bank account history.

Almost all financial institutions use ChexSystems to assess a person’s creditworthiness. A banking history may prevent you from opening an account, limiting access to additional bank services and products.

A second chance bank account can be a lifeline for people who have difficulty opening a bank account. As a result of second banking, formerly incarcerated people and unbanked communities can access financial services.

Here, we will explore top banks that provide Second Chance Banking With Overdraft Protection.

Let’s dive into it.

Table of Contents

What is Second Chance Banking?

The second chance banking program helps people who normally aren’t able to open a checking account. The second chance banking option at a financial institution usually offers a special checking account without reviewing the client’s banking history.

A second-chance checking account often has limited banking features to minimize the risk of bank fees. For example, many second-chance checking accounts don’t include checks or debit cards to avoid overdraft fees.

Other banks may charge lower monthly maintenance fees or require a lower minimum balance to make it easier to manage the account.

How Does Second Chance Banking Work?

Second chance bank account applications are typically not evaluated based on your ChexSystems report. You will be reported for your ongoing ChexSystems activity regardless of whether a bank checks your previous activity for your application.

You may be able to build up a positive history with ChexSystems as you use the account over time. Additionally, Second Chance Banks That Don’t Use Chexsystems may provide opportunities for those seeking to rebuild their banking reputation In the meantime, a second chance bank account may enable you to access essential banking services while your older reports are deleted from your ChexSystems profile.

What is Overdraft Protection?

Overdraft protection allows customers to overdraw their checking accounts, generally for a fee, from some banks and credit unions. Overdraft protection allows you to clear transactions even if there are not enough funds in your account.

An overdraft occurs when transactions cause the balance of a bank account to drop below zero. The failure of an automatic bill payment (ACH transfer) or the denial of debit card transactions may occur without overdraft protection. In this situation, many banks charge a fee for non-sufficient funds (NSF). Other negative consequences of failed transactions include:

- Merchant fees

- The late fee

- Account cancellation

- Coverage cancellation (for insurance)

Debit card declines, or checks or ACH payments that bounce can be embarrassing for individuals, but they can have more serious consequences in the long run. If you’re willing to pay the fees associated with overdraft protection, you can avoid these negative situations.

How Does Overdraft Protection Work?

Account holders may opt-in for overdraft protection at the time of account opening or at any time thereafter. Some online banks offer overdraft protection for free, but most banks charge an overdraft fee per transaction. The number of transactions that occur before funds are added to the account to cover them can result in multiple overdraft fees in a single day. Even when overdraft protection is in place, some transactions, such as bounced checks, may result in non-sufficient funds fees.

Who Needs Second Chance Banking?

A second chance Banking may be necessary if you are unable to open a standard checking account. This can happen for several reasons. Here are a few examples:

- Your banking history is poor, such as abandoning an account with a negative balance

- A bank fraud investigation has been initiated against you

- If you shared an account with someone who has either of the above issues

- A serious crime has been committed against you

- If you are a minor or a young adult with no banking history,

- It has been a long time since you have been banked

Top Second Chance Banking With Overdraft Protection

Chime

Chime’s online checking account does not require a minimum balance or deposit and may be a good option for students. Additionally, there are no fees associated with overdrafts, foreign transactions, or transfers.

A direct deposit account may help you manage your budget more easily because you can access your funds quickly. You can withdraw cash without paying bank fees at one of more than 60,000 ATMs.

Additionally, you won’t pay overdraft fees, as Chime will simply decline debit card purchases if you can’t cover them. SpotMe covers up to $200 in overdrafts for SpotMe customers to minimize inconvenience at the register.

Chime Features

- The minimum initial deposit/balance requirement is $0

- There is no monthly maintenance fee

- There are no other fees

- Accepts debit cards

- More than 38,000 ATMs are in-network

- Nationwide availability

Chime Pros and Cons

| Pros | Cons |

|---|---|

| No monthly fees | Limit of one account per person |

| No minimum deposit required | No physical branches, only an app |

| No fees for overdrafts, transfers, or foreign transactions | Low APY on savings |

| Save money with Round Ups feature |

Go2bank

Go2bank’s overdraft protection policy, which costs $200, is higher than that of other banks. Please read the fine print before signing. You must pay off overdrafts within 24 hours, or Go2bank will charge you $15.

You don’t need a ChexSystems report or credit check to open a Go2bank account, and there is no minimum balance requirement. The interest rate on Go2bank’s high-yield savings accounts is 4.50%, competitive with other online banks.

One of the significant drawbacks of Go2bank is the amount of fees it charges. A $5 monthly account fee can be avoided by having payroll or government benefits directly deposited. You will also be charged for withdrawing money from an ATM outside your network or depositing cash into your account.

Go2bank Features

- A $200 overdraft protection is available

- Direct deposit will pay you up to two days early

- The fee is waived with eligible direct deposit; otherwise, it is $5.

- There are no hidden fees

- There is no minimum balance requirement

Go2bank Pros and Cons

| Pros | Cons |

|---|---|

| No minimum balance is required to open an account | $5 monthly fee without direct deposit |

| No credit or ChexSystems reports pulled | $4.95 fee for cash deposits |

| Overdraft protection up to $200 | $3 fee for withdrawals from ATMs outside the network |

| $15 charge for unpaid overdrafts within 24 hours |

Varo Bank

Varo lets you open a bank account without taking your credit history or ChexSystems report into account. There are no monthly fees or minimum balance requirements with Varo accounts, and it offers an online checking account.

The Varo high-yield savings account offers a 5.00% annual percentage yield (APY), provided that your Varo accounts end each month with a positive balance if you make a direct deposit of $1000 or more per month. A downside of this high-yield account is the $5,000 cap on the 5.00%APY.

Varo Bank Features

- Minimal fees

- Protection against overdrafts

- An on-the-go banking app that is fully functional

Varo Bank Pros and Cons

Here’s the information presented in a table format:

| Pros | Cons |

|---|---|

| No monthly fees or minimum balance requirements | High APY on savings requires direct deposit |

| Direct deposit savings account with a high APY of 5.0% (as of March 19, 2024) | $5,000 cap on APY earnings (as of March 19, 2024) |

| ChexSystems or credit reports aren’t pulled for new accounts |

SoFi

SoFi is an online bank offering savings and checking accounts with interest. Savings account customers with direct deposits can earn as much as 4.60% APY, and checking account customers can earn as much as 0.50%.

As a result, SoFi’s checking account is the best among second-chance banks. The bank doesn’t charge a monthly fee or minimum balance requirement.

The ChexSystems report isn’t a requirement to open an account with SoFi if you are looking for a second-chance bank. If you use a SoFi debit card, you can also earn 15% cash back on selected purchases.

SoFiFeatures

- There are no account fees

- Approximately 55,000 ATMs within the Allpoint Network are fee-free

- A Vault-based savings system based on goals

- The mobile check deposit method

- The direct deposit method

- Financial advising and career coaching are available to SoFi members

- A bill pay system that is automated

- A free P2P payment system

- The SoFi MoneyTM World Debit Mastercard is available after your SoFi Money account has been funded with at least $1.

- You can freeze your SoFi Money Debit Mastercard on the go

SoFi Pros and Cons

| Pros | Cons |

|---|---|

| High APY available on savings with direct deposit, up to 4.60% | Deposits of at least $5,000 required every 30 days for high APY |

| Checking accounts with direct deposit offers APY of 0.50% | No physical branches |

| No monthly fees | Daily ATM transaction limit of $1,000 |

| No minimum balance requirement |

How To Choose The Best Second Chance Bank With Overdraft Protection?

The following factors should be considered when choosing a second chance bank.

- Second-chance accounts may have higher fees due to the higher risk involved. Those who are looking for second-chance banks should avoid monthly fees as well as fees for overdrafts and foreign transactions.

- You can open an account with a minimal initial deposit at banks that don’t require you to carry a minimum balance.

- An interest-bearing account works for you by earning interest on your money. Several banks offer high-yield savings accounts that earn over 4.50% APY, and some, including SoFi, also offer interest-bearing checking accounts.

- The programs offered by second-chance banks can help you improve your financial well-being. If you need a second-chance bank, your credit history is likely to be blemished. You can rebuild your credit with savings plans and credit cards offered by some second-chance banks.

How To Open A Second Chance Bank Account?

You can open a second chance bank account by following these steps:

Shop Around

The best second chance bank accounts can be found by researching and comparing them like those provided above. You should consider potential fees, deposit requirements, services, and limitations when considering your options. Additionally, you can check with the bank if upgrading your account will be possible.

Contact The Bank To Apply

Most banks offer online applications, but they may also allow you to apply in person if they have physical branches. A government-issued photo ID and some basic information about yourself will likely be required.

Fund Your Account

A bank account cannot be funded if you don’t have another bank account from which to transfer money. It’s fortunate that most of these accounts don’t require opening deposits. You can deposit a check via the bank’s mobile app or set up direct deposit. The bank may allow you to fund your account with a credit card, but this could result in a cash advance on your card, which is expensive.

Should You Open A Second Chance Bank Account?

You should definitely consider a second chance bank account if you have been struggling without a traditional checking account. Additionally, it will help you avoid the many high fees associated with alternative banking products while also reestablishing your credit history.

The cost of check cashing services is high, and they are not always reliable. Additionally, prepaid debit cards often charge recurring fees. The second chance bank account comes with a Visa or MasterCard debit card that can be used anywhere that accepts these cards. The withdrawals and deposits you make in-network are usually fee-free.

A checking account-connected ATM card alone can relieve a lot of stress. This card can be used anywhere debit or credit cards are accepted, so you don’t need to load funds on a prepaid card every time you make a purchase or pay a bill.

Your second chance bank account will allow you to write checks, pay bills online, transfer funds into and out of the account, and use your debit card for ATM transactions, online shopping, and purchases at point-of-sale.

The benefits of a second chance bank account can be downright liberating if you’ve struggled with managing your finances without a traditional checking account. You should apply for one of the checking account providers listed here. This will simplify your finances now and create an opportunity for you to get a traditional bank account in the future. Which Banks Offer Second Chance Checking Accounts can be a helpful resource in finding institutions that may assist you in rebuilding your banking history

Benefits of Second Chance Banking With Overdraft Protection

Second chance banking accounts benefit people who cannot open traditional bank accounts.

Useful Bank Features & Services

A second chance checking account offers many of the same features and services as a traditional checking account. Second chance accounts may enable users to access debit cards for purchases and ATM transactions. Additionally, users may be able to access a checkbook to pay bills and other obligations.

The second chance bank system also allows individuals to receive their paychecks directly from their employers. This also means that account holders can use a mobile banking app and all of the features that come with it, including Zelle® payment options and automatic bill payment.

Safeguard Your Money

A second chance bank account provides users with the opportunity to store money at banks insured by the Federal Deposit Insurance Corporation (FDIC). The FDIC protects up to the maximum limits amounts deposited in qualifying accounts. You are much safer keeping your funds in the bank rather than keeping them as cash.

Build Your Bank History

A second chance bank account can help rebuild your ChexSystems score if you use it responsibly – no overdrafts, timely fees, etc. Your bank may even allow you to open a regular checking and savings account after you demonstrate responsible use of a second chance bank account.

The negative ChexSystems marks on your consumer report remain on it for five years[3]. However, opening a second-chance bank account can improve your negative score quickly.

Save Money

You can avoid depending on a check-cashing service by using a second chance bank account. Generally, check cashing services charge exorbitant fees that eat up your hard-earned money.

Second Chance Banking vs. Regular Banking

There is a set of requirements that must be met to open a second chance checking account, which differs from a regular checking account.

The first thing most banks look at when considering your application for a standard checking account is your ChexSystems report, which lists any blemishes in your banking history, such as unpaid overdrawn balances. The ChexSystems report is one of the most common reasons for the denial of checking account applications.

In contrast, second chance accounts offer a second chance to people with checkered bank histories by overlooking their ChexSystems report entirely. A first-time account can also be opened by minors and young adults who do not have a banking history.

A second chance account is designed to help you overcome a poor credit history. It also comes with more restrictions than a regular account. There are usually the following restrictions:

- There is no overdraft facility.

- The inability to write checks

- ATM withdrawal limits

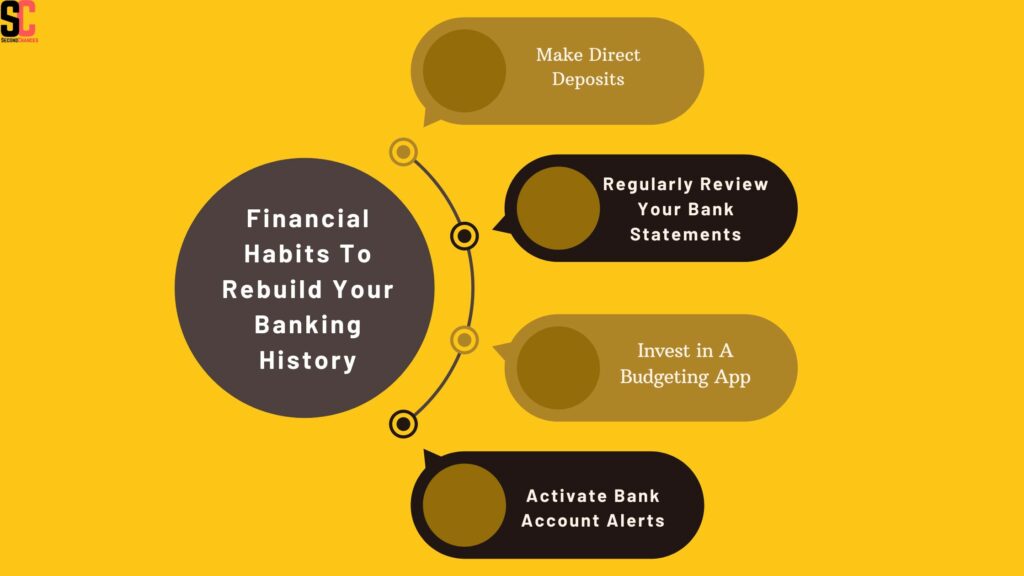

Financial Habits To Rebuild Your Banking History

The following strategies and tips can help you manage your second chance bank account and eventually graduate to a standard banking account:

Make Direct Deposits

Direct deposits will ensure that you consistently add money to your account if you have trouble maintaining a positive balance. You can receive tax refunds, government benefits, and paychecks via direct deposit without having to deposit a check.

Regularly Review Your Bank Statements

Checking your bank statements every month can also help you monitor your account balance. If you analyze your monthly expenses and income, you can determine whether any expenses can be cut or monitored more closely. Additionally, you might want to use strategies such as the 50/30/20 rule or zero-sum budgeting.

Invest in A Budgeting App

There are features in the best budgeting apps that can help you track your spending habits more effectively. There are some budgeting apps that help you cancel or get refunds for bills and subscriptions. You can also set alerts for upcoming bills in many budgeting apps.

Activate Bank Account Alerts

Many banks also allow you to set alerts for when a certain balance is reached in your account. As a result, you will be able to build good banking habits.

FAQs

What Makes Me Ineligible For A Standard Bank Account But Eligible For A Second Chance Account?

Some banks use a credit reporting agency called ChexSystems to check your banking history. The closing of your last bank account due to your inability to manage the account will be reported in a ChexSystems report, which might prevent you from opening a standard bank account. Second-chance bank accounts are not covered by ChexSystems.

Can I Upgrade From A Second Chance Bank Account To A Regular Account?

The more money you keep in your second bank account for some time, the more likely it is that your second bank account will be upgraded to a regular account because you have rebuilt your banking history.

What Should I Look For In A Second Chance banking?

Second chance bank accounts have opening requirements, limitations, and fees. Second chance bank accounts may offer debit cards and checks, whereas others do not, preventing overdrafts.

Will I Have Access To Online Banking With A Second Chance Account?

You can manage your second chance banking online with most banks.

Does Using Second Chance Banking Improve My Credit Score?

A second chance banking will not improve your credit score on its own. As a result, you will be able to pay your bills on time each month, which will boost your credit score. A secured credit card may also help you establish a positive credit history.

Can I Open A Second Chance Checking Account If I Have A Negative Balance At Another Bank?

Yes. You might not even be aware of your negative balance or history with another bank if you don’t do a credit or ChexSystems check to open an account.

Conclusion

Second chance banking isn’t ideal for everyone, but it can be a good choice for those who have been denied a traditional checking account. You might also want to consider getting a free copy of your credit report while you’re working to get back on track with your banking.

Even though credit history doesn’t directly affect your ability to get a better bank account in the future, building credit can make you more financially stable in the long run. This will help prevent the recurrence of some of the problems causing your current situation.