Do you want to know how to obtain Wells Fargo Second Chance Banking without any complications? Your search ends here.

Wells Fargo is the fourth-largest bank in the country, and it frequently offers incentives to new customers. There are always promotions at Wells Fargo bank, and if you time things right and open a new account while they are available, you can earn a pretty tidy bonus.

Wells Fargo offers convenient bank account management for those who like to keep everything in one place. The bank offers checking, savings, and CD accounts but not money market accounts. Additionally, it provides commercial, small-business, corporate, and investment banking services.

This article aims to explore everything about Wells Fargo Second Chance Banking, how they work, and what they can offer you.

Let’s dive in.

Table of Contents

What is Second Chance Checking Account?

Second-chance checking accounts are available to customers who cannot qualify for standard checking accounts due to blemished banking profiles. Special accounts typically come with mandatory fees, more restrictions, and fewer conveniences. Nevertheless, they allow consumers to stay in the banking system and demonstrate that they can handle their accounts responsibly.

A second-chance account customer may qualify for a standard checking account with fewer fees and more convenience after six to twelve months. Customers may be able to request that automatically, or they may need to make a request to the bank.

What is Wells Fargo Second Chance Banking?

The Wells Fargo Company was founded in 1852 in California. A $1.7 trillion in assets allows the institution to serve customers coast to coast, overseas, and digitally. As America’s fourth-largest commercial bank, the institution offers various services, including checking and savings accounts, credit cards, loans, and brokerage accounts.

A bank with branches across the country may be the right choice for those seeking a for all of their financial needs.

How Secure is Wells Fargo Second Chance Banking?

A Wells Fargo account and mobile app provide advanced security measures to protect your funds. Several security measures are taken to protect customers, such as enhanced encryption, dual verification, safe sign-in, automatic sign-off, fraud monitoring, and debit and credit card security.

Despite this, the bank has been involved in financial scandals in the past. A fine and settlement of $3.7 billion was ordered by the Consumer Financial Protection Bureau against Wells Fargo in 2022 alone. The accounts at Wells Fargo are FDIC-insured, up to $250,000 per depositor, per ownership category, if the bank fails.

Types of Wells Fargo Second Chance Banking Accounts

Wells Fargo Second Chance Banking offers a range of accounts to meet customers’ needs, regardless of how they bank. The following are some key takeaways:

Everyday Checking

The checking account is designed for everyday use. There is a low monthly fee that can easily be waived by meeting an account requirement. For a primary checking account, there’s a fee that can be avoided through two methods. Firstly, if you use your debit card for at least 10 purchases or payments each month, the fee is waived. Additionally, if the primary account owner falls between the ages of 17 and 24, you’ll receive a $5 discount on the fee.

You can deposit checks via a mobile device, pay bills online, and receive text messages through the Everyday Checking account. The Wells Fargo tools for budgeting, cash flow management, and spending will also be available to you.

Additionally, the bank provides solid security measures. As part of this service, 24/7 fraud monitoring is provided, zero-liability protection is offered, account alerts are provided, and debit cards can be chipped. The features listed above protect you and your money.

Everyday Checking Features

- There is no standard interest rate.

- The monthly service fee is $10.

- There is no APY

- You can overdraw up to three times a day.

- The overdraft fee is $35

- There is a $10 cashier’s check fee.

- $2.50 for non-Wells Fargo ATMs

- The fee for a money order is $5

- The international purchase fee is 3%

- The Wells Fargo Worldwide Military Banking program waives the $10 monthly service fee for account holders under 24 years of age with a $500 daily minimum balance, $500 in total qualifying direct deposits, accounts linked to campus debit cards or ATM cards, or eligible monthly noncivil military direct deposits.

Prime Checking

The Wells Fargo Prime checking account requires only $25 to open. Still, you must maintain a minimum balance of $20,000 across qualifying accounts at Wells Fargo to avoid the $25 monthly maintenance fee.

There are several types of accounts that are eligible for withdrawals, including savings accounts, certificates of deposit, checking accounts, and Wells Fargo Advisors investment accounts. The ATMs outside Wells Fargo’s network won’t charge you a fee. The bank will also reimburse an out-of-network fee incurred by another bank in the U.S. and abroad.

The Prime Checking account earns the same yield regardless of how much you deposit. This account may qualify you for a lower lending rate if you make automatic payments. There are more benefits for Wells Fargo’s prime checking account holders, including APY and discounts on loans:

Prime Checking Features

- The monthly service fee is $25.

- The standard interest rate is 0.01%

- The APY is 0.01%

- Free cashier’s check

- Three daily overdrafts are available

- The overdraft fee is $35

- The ATM use fee at a non-Wells Fargo location is $0

- The fee for a money order is zero

- The international purchase fee is 3%

- Discounted safe deposit box rental

- 1% off foreign currency purchases

- There will be no $25 monthly service fee if you have a balance of $20,000 or more in linked accounts

Premier Checking

This account offers Prime Checking benefits, including unlimited worldwide reimbursements of non-Wells Fargo ATM fees, free wire transfers, and no foreign transaction fees. A combined account balance of more than $250,000 is required to avoid the $35 monthly fee. The Premier Checking account from Wells Fargo pays a small annual percentage yield. A minimum deposit of $25 is required. A $35 monthly fee is charged for this account, which can only be waived if you have $250,000 in linked Wells Fargo accounts. There are also discounts on investment advice and worldwide ATM fee waivers on certain loans and deposit accounts.

Premier Checking Features

- The standard interest rate is 0.01%

- The monthly service fee is $35.

- The APY is 0.01%

- There is no charge for cashier’s checks

- The number of checks in your wallet is 0

- Three overdrafts per day are allowed

- The overdraft fee is $35

- The fee for a money order is zero

- The use of ATMs that are not Wells Fargo ATMs is free

- We provide customer service 24 hours a day, 7 days a week

- The investment advisory fee has been discounted by 0.10%

- There is no international purchase fee

- A 2% discount will be applied to foreign currency cash purchases

- Accounts with a balance of $250,000 or more each statement period are exempt from the monthly service fee

Clear Access Banking

A low-cost account option designed for teens, students, and first-time account holders, Clear Access Banking can be a good option. A minimum deposit of $25 is required to open this account. A minimum balance is also not required after that. As a result of its no overdraft fees, Clear Access Banking won’t charge you for overdrawing your account.

If you’re 13-24 and have a Wells Fargo Campus ATM or debit card attached, you can waive the $5 monthly service fee. The account does not allow paper checks, but it does offer debit cards, Zelle, and digital wallets, which may be more appealing to tech-savvy customers.

Clear Access Banking Features

The following features are available on this checking account:

- The monthly service fee is $5.

- There is no standard interest rate.

- There is no APY

- There are no overdraft services available.

- There is a $10 cashier’s check fee.

- A non-Wells Fargo ATM fee of $2.50 applies.

- The fee for a money order is $5

- The international purchase fee is 3%

- A waiver of the monthly service fee will be given to 13- to 24-year-olds, account holders with a Wells Fargo Campus ATM card or a Wells Fargo Campus debit card, and eligible military direct deposit accounts.

Way2Save Savings

Way2Save Savings accounts from Wells Fargo require just a $25 opening deposit. You can watch your funds grow by setting up automatic deposits from a linked checking account. You’ll also earn 0.01% APY.

There’s a $5 monthly service fee for the account, but you have options to avoid it. You can waive the fee by either maintaining a balance of at least $300 or setting up automatic monthly transfers of $25 or more. If you opt for the Platinum Savings account, you can enjoy a higher APY. However, failing to maintain a minimum daily balance of $3,500 will result in a higher monthly fee.

Way2Save Savings Features

- The monthly service fee is $5.

- The standard interest rate is 0.01%

- The annual percentage yield is 0.01%

- There is an option for overdraft protection.

- Those under the age of 24 who maintain a $300 minimum daily balance, make an automated transfer, or have a linked Wells Fargo checking account are exempt from the monthly service fee.

Where Can I Find Wells Fargo Second Chance Banking?

There are 13,000 ATMs and over 6,000 physical branches of the bank, which can be found online and on mobile devices. For those seeking second chance checking accounts, it’s worth exploring Which Banks Offer Second Chance Checking Accounts. There are physical locations of the bank in 40 states, plus Washington, D.C. The bank does not have locations in Oklahoma, Louisiana, Missouri, Kentucky, West Virginia, New Hampshire, Vermont, Maine, Massachusetts, and Rhode Island.

Procedure For Opening Wells Fargo Second Chance Banking Account?

Follow the given steps to follow the Wells Fargo Second Chance Banking Account:

- To open an account, you need to visit Wells Fargo’s official website. Most accounts can be opened online by clicking the “Open Now” button for the account you wish to open.

- On the next page, you must enter information such as your Social Security number, government-issued I.D., and employment details. The initial deposit must also be made at this time.

- The right side of the application page has a Live Help Chat option for any questions you may have during the online application process.

- Alternatively, you can schedule an appointment with a banker, visit a local branch, or call 1-800-869-3557. You must open an Opportunity Checking® Account or a Step Rate CD at a branch.

How To Qualify For Wells Fargo Second Chance Banking?

Eligibility Criteria

The following requirements must be met to open this account:

- A minimum deposit of $25 is required.

- A valid Social Security number or tax identification number

- A valid state-issued I.D. is required.

- Your U.S. address must be valid.

- An application for a regular checking product was denied because of credit or banking history.

Required Information

The following information will be requested during the application process:

- Address, date of birth, and name

- Tax ID number or Social Security number

- A driver’s license or other state-issued identification

- Contact information

- Employment information

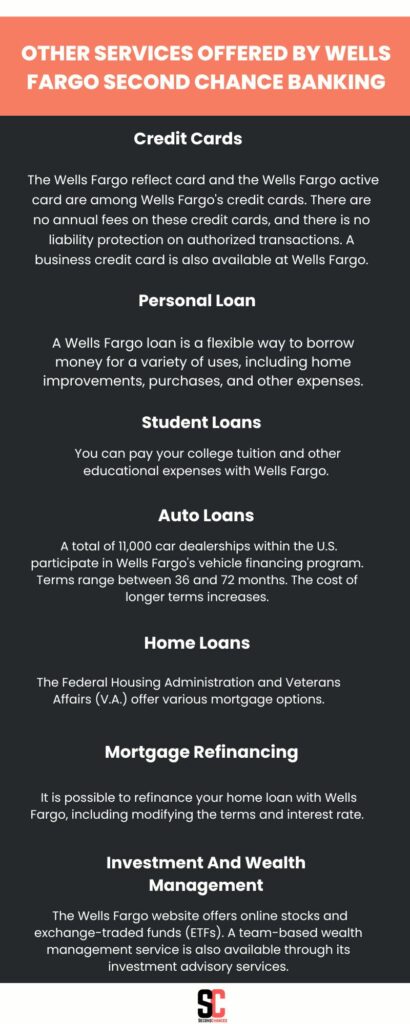

Other Services Offered By Wells Fargo Second Chance Banking

Wells Fargo offers its customers a wide variety of checking, savings, and CD accounts as well as the following products and services:

Credit Cards

The Wells Fargo reflect card and the Wells Fargo active card are among Wells Fargo’s credit cards. There are no annual fees on these credit cards, and there is no liability protection on authorized transactions. A business credit card is also available at Wells Fargo.

Personal Loan

A Wells Fargo loan is a flexible way to borrow money for a variety of uses, including home improvements, purchases, and other expenses.

Student Loans

You can pay your college tuition and other educational expenses with Wells Fargo.

Auto Loans

A total of 11,000 car dealerships within the U.S. participate in Wells Fargo’s vehicle financing program. Terms range between 36 and 72 months. The cost of longer terms increases.

Home Loans

The Federal Housing Administration and Veterans Affairs (V.A.) offer various mortgage options.

Mortgage Refinancing

It is possible to refinance your home loan with Wells Fargo, including modifying the terms and interest rate.

Investment And Wealth Management

The Wells Fargo website offers online stocks and exchange-traded funds (ETFs). A team-based wealth management service is also available through its investment advisory services.

Pros and Cons of Wells Fargo Second Chance Banking

Pros

- There are over 12,000 ATMs across 37 states and the District of Columbia, making Wells Fargo one of the most accessible large banks in the country.

- Many Wells Fargo deposit accounts are subject to maintenance fees, but the bank offers several ways to avoid them. It is easy for most clients to qualify for one of the many waivers available.

- Wells Fargo partnered with Intuit in 2017 to offer seamless and completely secure connections between its customers and Mint, QuickBooks, and TurboTax. Wells Fargo customers can easily share data with Intuit products without risking the security of their accounts due to this pioneering move.

Cons

- Banks with brick-and-mortar locations often offer lower APYs than their online counterparts. Despite this, Wells Fargo’s savings rates are lackluster (currently 0.01%-0.02%). As a result, if you fail to avoid the monthly fee, for example, if your account dips below the minimum daily balance, the account may essentially earn a negative amount.

- Wells Fargo charges an overdraft fee of $35 every time you overdraw your account with its Debit Card Overdraft Service. The bank’s policies allow you to overdraw up to three times per day, which means you could be looking at $105 in overdraft fees in one day.

- There have been several costly scandals at Wells Fargo since 2016. News broke in 2016 that employees had engaged in illegal practices for years, including charging customers extra for opening fake accounts, reposing cars and homes improperly, and having to pay billions in fines imposed by the Comptroller of the Currency, the Consumer Financial Protection Bureau, and the Securities and Exchange Commission.

Who Is Wells Fargo Best for?

Wells Fargo will appeal to customers who are looking for a bank that has a large geographic footprint and is well-established. Those who are interested in it should:

- There is a need for a bank to be present in the majority of the states, including the District of Columbia

- Keep a minimum balance in their checking and savings accounts to avoid fees

- Use Mint, QuickBooks Online, or TurboTax online for accounting and tax preparation

Customer Service And Platform At Wells Fargo Second Chance Banking

Customers of Wells Fargo can also access their accounts via the bank’s highly-rated mobile apps, which are available for both iOS and Android. Through these apps, customers can manage their accounts, track their investments, deposit checks, transfer funds, and pay bills from anywhere. In addition to Zelle, Wells Fargo’s mobile app lets you send and receive funds.

Wells Fargo’s customer service representatives are available 24/7 if you have questions or complaints. Alternatively, you can contact the bank via Facebook, Twitter, or its knowledge portal by calling (800) 869-3557.

Wells Fargo Second Chance Banking Relationship Benefits

Wells Fargo Bank offers fee waivers on most of its accounts to customers who meet certain criteria. Additionally, Prime Checking customers who open other accounts with the bank receive higher interest rates. The company does not offer these benefits to customers with other checking accounts.

Those who maintain a certain balance can also benefit from additional perks, such as discounts on Wells Fargo loans and investment accounts. Some of these well-known perks might appeal to those looking for more than just banking services from Wells Fargo.

FAQs

Is Wells Fargo Considered A Good Bank?

In terms of banking services, multiple account options, and online and physical accessibility, Wells Fargo is a good choice. Those seeking high rates of interest on their savings or deposits would think otherwise.

Is Chase A Better Bank Than Wells Fargo?

The answer depends on what you need. Wells Fargo’s CD rates and APYs are slightly higher than Chase’s, but Chase has more checking options and CD terms. Additionally, Wells Fargo does not require an opening deposit. It operates in every lower state and has more ATMs.

What Are The Disadvantages Of Wells Fargo Second Chance Banking?

The disadvantages of Wells Fargo Second Chance Banking include low savings rates, expensive overdraft fees, and fewer CD terms.

How Does Wells Fargo Compare To Other Big Banks In Terms Of Mobile And Online Banking Features?

Mobile check deposits, account transfers, and Zelle are all available on Wells Fargo’s highly rated mobile app. Online banking features include bill pay, alerts, budgeting, and more. The digital banking capabilities of Wells Fargo are comparable to those of Chase, Bank of America, and Citigroup.

How Extensive Is Wells Fargo’s Atm Network?

At Wells Fargo ATMs, customers can make fee-free transactions. There are 11,000 ATMs in 36 states and Washington, D.C. There are usually out-of-network ATM fees unless you have a premium account.

Are Wells Fargo Promotions Taxed?

You can report your Wells Fargo bonuses on your tax return at the end of the year with the tax form Wells Fargo will provide.

Are Wells Fargo Promotions A Good Deal?

There aren’t any bad Wells Fargo bank promotions right now, but they’re not the best, either. There are only two promotions available from Wells Fargo right now, and they’re for the same account. The bank is not offering any promotions for its other accounts, even for business accounts.

How Do Wells Fargo Promotions Compare To Other Bank Promotions?

The promotions offered by Wells Fargo bank are a bit lacking compared to those offered by other big banks. There are currently more Chase Bank promotions available for different types of bank accounts, and the bonus amount may be higher as well.

When Will I Get My Wells Fargo Bonus?

Wells Fargo usually pays out bonuses within 30 days of meeting the offer’s requirements, regardless of the promotional offer.

Does Wells Fargo Offer Free Personal Checking?

Wells Fargo does not appear to offer free checking. Most banks offer free checking, so that’s unheard of. However, they offer free trades. They also offer interest-bearing checking accounts.

Who Is Eligible For A Wells Fargo Checking Account?

It’s best to speak with a financial advisor at a local branch to find out if you are eligible for a Wells Fargo checking account. A financial adviser can help you determine which account is right for you.

How Much Money Can Someone Withdraw From A Wells Fargo Checking Account Each Day?

There is no doubt that Wells Fargo is one of the most popular financial institutions in the United States. A checking account can be withdrawn up to $10,000 per day.

Conclusion

Wells Fargo is one of the country’s largest banks and could be an excellent choice for those who don’t plan on shopping for loans or products across several banks. The rates on its savings and checking accounts are comparable to those of other traditional banks, but they cannot compete with online banks, which have fewer overhead costs.

The bank has consistently stated its commitment to building its reputation and strengthening its risk management and compliance processes despite several reputational and subsequent financial penalties.