What is Section 8? What is maximum Section 8 income? How to apply for Section 8 housing vouchers within minutes. If these are your questions, your search ends here.

When you lose your job, suffer an injury, or become disabled, you will find yourself struggling to make ends meet.

If you run out of your emergency fund or savings, it would be difficult to afford rent, and you might lose your house. The Section 8 housing choice voucher program can provide assistance in this type of scenario.

Section 8 vouchers are designed to help individuals and families with very low incomes find housing. Nevertheless, not all individuals and families qualify for assistance under the program. A Housing Voucher Program provides housing vouchers to qualified applicants who meet the income requirement and other eligibility requirements.

The given guide will provide you with everything about Section 8 income and how to apply for it.

Let’s get started.

Table of Contents

What Is Section 8 Housing?

Section 8 Housing was established by the Housing Act of 1937. The program provides safe and sanitary shelter to low-income, disabled, and elderly individuals. This is accomplished through the Housing Choice Voucher program.

A voucher is a portable subsidy that low-income families can use to lower their rent monthly. Public housing agencies (PHAs) administer the vouchers under the supervision and funding of HUD.

The PHA determines eligibility based on family size and household income. The gross annual income of the applicant cannot exceed 50% of the median income for that area. The law requires 75% of vouchers to go to families earning less than 30% of the area’s median income.

The rent and utilities you pay in Section 8 Housing are 30% of your monthly adjusted gross income. PHAs managing family vouchers pay the remaining 70% directly to landlords.

How Does It Work?

A subsidy provided by a municipal public housing agency correlates with the area’s fair market rent. This is calculated based on the difference between 30% of the household income and the PHA’s payment standard, which is approximately 80 to 100% of fair market rent. A tenant pays this amount to their landlord.

Tenants must pay the difference if they choose a residence above fair market rent. If the rental price is below the fair market, I can keep the difference. There must be a monthly rental rate that is competitive with unsubsidized rentals in the area.

What is Maximum Section 8 income?

The Section 8 income limit is important in determining Section 8 housing program eligibility. The US Department of Housing and Urban Development establishes income limits based on median incomes for the area where you live.

The household income of applicants must be at or below 50% of the area median income to qualify for the Section 8 housing program. There are few housing authorities that set income limits, so applicants should check with their local housing authority to learn about the income limits set by their authority.

The income limit for Section 8 housing varies from state to state and is also determined by the size of the household and income of the applicant. A household of eight people in New York faces income restrictions ranging from $33,950 for a single-person household to $8300.

Eligibility Criteria For Section 8 Housing Voucher?

Although the program’s income limit determines whether you qualify for assistance, there are other criteria you must meet to qualify, such as:

Citizenship Status

Section 8 vouchers are only available to citizens of the United States and qualified noncitizens with legal immigration documents. When applying for Section 8 housing, a certification form stating whether a person is a citizen or an eligible alien is required.

The public housing authorities may also request additional documents to verify citizenship status, including registration cards, Social Security cards, passports, or resident alien cards.

Family Status

The Section 8 housing choice voucher program requires applicants to meet the definition of a family, as defined by HUD. The HUD defines family as an individual or group that meets the following criteria.

- Families

- A family member with a disability

- At least one household member must be 62 years or older

- Formerly lived with individuals receiving Section 8 income assistance but live alone now that the family members have moved out.

- They have been displaced from their homes.

- Eviction History

The Section 8 housing choice voucher program requires applicants to have a positive rental history. Those who have been evicted from public housing due to drug-related or criminal activity cases are ineligible for the program. Additionally, if you have been convicted of manufacturing methamphetamine in a public housing project subsidized by HUD, you will be denied Section 8 income assistance.

How To Apply For The Section 8 Housing Choice Voucher Program?

- You can find your local public housing agency by searching online. It’s the first step. You can visit the Department of Housing and Urban Development to locate your local Public Housing Agency. There is a section of the website that categorizes PHAs by state, city, zip code, and other useful information.

- Verify whether you are eligible for the Housing Choice Vouchers program. A PHA can help determine a person’s eligibility. The applicant must be at least 18 years old and a US citizen or eligible noncitizen with a household income below 50 percent of the median income in the area. The size of the family also determines eligibility.

- Determine if there are any restrictions or preferences at the local PHA. There are times when local PHAs will give preference to applicants who cannot receive assistance from others – such as the elderly, people with disabilities, the homeless, and local residents. If you are on a PHA’s preference applicant list, please let them know. Otherwise, your waitlist time may be extended.

- Section 8 Housing Choice Vouchers make it possible for low-income people to afford housing. A Section 8 Housing Choice Voucher can be applied for through your local housing authority or online. There is no cost associated with the program.

- You must complete all the required parts of the application. There are a number of factors that determine how long an application can be, but most applications require applicants to provide the following information: name, date of birth, Social Security Number, gross income, mailing address, e-mail address, housing history, criminal history, phone number, etc. If you want your application to be processed efficiently and completely, ensure that you follow all instructions provided by the housing authority.

- The application must be submitted. Make sure that the full application is submitted by the due date specified by the PHA, or risk having your application rejected.

- Please wait for the PHA to process your application. It can take up to a few months to process an application, but once it is processed, housing authorities will either notify the applicant by mail or ask them to log into an online portal to confirm their placement on the waiting list.

Factors To Consider Before Applying For Section 8 Income Housing

The household must also meet the eligibility requirements discussed above, but certain factors can disqualify it. A few of these factors are:

- The possession of a home or substantial assets

- A full-time student at a college or university

- The household member owes money to the PHA or another housing authority

- An individual living in subsidized housing has been convicted of producing methamphetamine.

What If My Section 8 Income Goes Up?

In the event that your annual Section 8 income changes, it’s important to notify your housing authority as soon as possible. Because your income largely determines Section 8 housing choice vouchers, your calculated rent amount may need to be adjusted according to your new income level. Although you’ll still pay 30%, your rental amount will increase because your income will be higher.

This is also true if your annual income decreases. The PHA can lower your rental amount so that you continue to pay 30% of your income, but you will pay less.

Section 8 houses for rent with no deposit near me may be available, offering affordable housing options without the need for a security deposit. Keep in mind that Section 8 housing choice programs may be terminated as you earn more and can pay full market value rent without assistance.

What If My Claim Is Rejected?

The decision to reject your Section 8 claim may be appealed. It is important to contact the appropriate agency or organization for guidance regarding the appeals process since it varies from agency to agency.

Section 8 appeals must be submitted within a specified deadline, typically 14 to 30 days from the date of the decision. Additionally, you may be required to attend an informal hearing or meeting in order to present your case. An advocate or representative may attend the hearing with you.

In order to ensure you receive your benefits, you will need to provide additional documentation such as income or household changes, medical bills, or other extenuating circumstances. Additionally, you must remain patient and persistent throughout the appeals process, which can take several weeks or months.

A denial of your appeal may mean that you need to look into other options, such as low-income housing programs, rental assistance programs, subsidized housing, or applying for disability in Florida. Keep up to date and seek out local agencies and organizations for help and support during the process.

Tips For Tenants Applying For Section 8

Section 8 applications can sometimes seem complicated and lengthy. These tips will increase applicants’ chances of getting approved for vouchers:

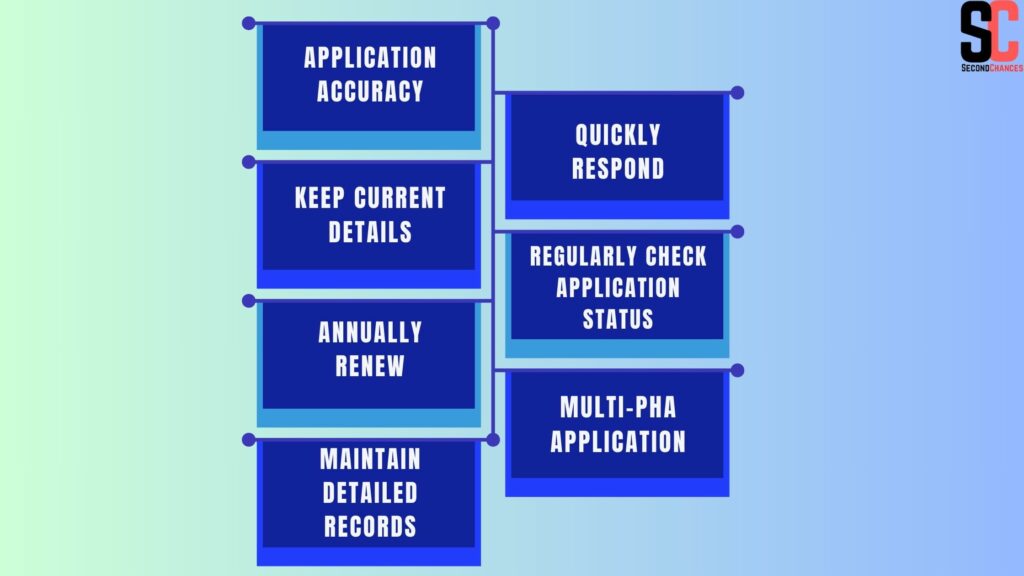

Application Accuracy

Ensure the initial PHA application form contains complete, clear, and accurate information. Check your income calculations and list all household members correctly. Applicants with errors may have their applications delayed or disqualified.

Quickly Respond

If the PHA asks for documentation or information regarding your application, respond promptly. Pay stubs, tax returns, photo IDs, and other required documents should be submitted promptly. To avoid delays, make sure to return any PHA phone calls or emails within 1-2 business days.

Keep Current Details

Keep your contact details updated with the PHA while you’re on the waiting list. Whenever your mailing address, phone number, or email changes, alert the PHA immediately so you won’t miss any time-sensitive notifications.

Regularly Check Application Status

When you apply for Section 8 waiting list, make sure to regularly check your status to ensure you’re still on the list and to get an idea of when you might be selected.. Ensure you know your number on the list so you can find out when vouchers may become available.

Annually Renew

Some local PHAs require applicants to confirm their interest and eligibility every year, so check if that’s the case for you. If so, renew your application every year to keep it active on the list.

Multi-PHA Application

Consider applying to more than one PHA in the area you are considering relocating to before issuance of the voucher. In case of a move, you may be able to maintain your place by transferring to a new waitlist.

Maintain Detailed Records

You should keep copies of all applications, letters, emails, and documentation you submit to or receive from the PHA. A thorough recordkeeping system protects you from potential problems.

Are Section 8 Housing Choice Vouchers Helpful?

The Housing Choice Voucher program does not specify the amount of rent assistance individuals and families can receive. However, public housing authorities in different states administer the program based on a specific payment standard, which also defines the below-market rent for a moderately priced home.

Housing units for Section 8 voucher recipients may be rented at rates above or below the standards set by local housing authorities. Generally, the program requires recipients to pay 30% of their monthly adjusted gross income towards rent and utility bills.

When the rent exceeds the payment standard, this payment standard can reach as high as 40%. The housing authorities in Los Angeles have set the payment standard at $2248 for two-bedroom apartments. According to the 30% rule, individuals with a monthly income of $2800 must pay around $840 in rent and utilities.

What is Section 8 Income Family Definition?

A family consists of:

- The family can have children or not. A foster child who is temporarily away from his or her family is considered a family member.

- The elderly family is defined as a household whose head or a single member is at least 62 years old; two or more people at least 62 years old; or at least one person at least 62 years old living with at least one live-in caretaker.

- A disabled family consists of a household head or single member with disabilities, two or more other members of the household with disabilities, or at least one person with disabilities who lives with a live-in caregiver.

- A displaced family is one where all members have been forced out of their homes due to government action, extensive property damage, or the home has been destroyed by a disaster (recognized by federal disaster relief laws).

- A remaining member of a tenant family resides in a home that is receiving voucher assistance after other family members move out.

- Those who do not fall into one of the above categories.

What Are The Responsibilities of The Tenant?

A one-year lease must be signed by the approved tenant and the landlord. A security deposit and timely rent payments are required of the tenant.

- A well-maintained unit is essential.

- In the event of a change in income, the PHA should be notified.

- Before applying for a Housing Choice Voucher or listing the property, both tenants and landlords should review the eligibility criteria detailed by the Department of Housing and Urban Development.

FAQs

How Do I Apply For A Housing Voucher?

A housing voucher must first be approved by the program before you can apply. The income requirements for receiving a housing voucher are specific. You must not have an income greater than 50% of the median income in your intended county or metro area. To apply for public assistance housing, please contact your local public assistance housing agency.

What Is Section 8 Housing?

Section 8 housing refers to the Housing Choice Voucher Program funded and run by the Department of Housing and Urban Development.

What is The Difference Between Low Income Housing And Section 8 Housing?

There are various low-income housing programs available to qualified tenants that subsidize their rental costs. There is often confusion between this term and low-cost housing and affordable housing.

There is a difference between Section 8 housing and all low-income housing.

How Long Is The Waitlist For Low Income Housing?

There are often long waitlists for low-income housing, especially Section 8. Thus, starting the application process as soon as possible and being as transparent as possible is crucial. Often, new buildings are developed or onboarded as low-cost housing options earlier than expected.

How Do I Qualify For Section 8 Housing?

To qualify for Section 8 housing, your income must be half or less of the area’s median income. Additionally, you cannot have been evicted from public housing within the last three years, and you must be a legal citizen or immigrant of the United States.

How Are Section 8 Voucher Amounts Determined?

The local housing authority determines the amount of a Section 8 voucher according to factors such as family size, income, and rental costs in the area. Most vouchers cover 30% of the family’s adjusted income towards rent.

How Are Section 8 Voucher Payments Made?

A voucher holder pays their landlord directly using a Section 8 voucher. A check is mailed to the tenant each month to cover the portion of rent determined by the voucher. A tenant pays a portion of the rent to the landlord, and the housing authority pays its share directly to the landlord.

Conclusion

Housing choice vouchers for Section 8 income are designed to provide low-income families and individuals with secure and affordable housing. Applicants must meet the income limits and other eligibility criteria of the program to qualify. The program sets income limits based on family composition, geographic location, and financial circumstances, ensuring equitable access to Section 8 housing for single mothers.