If you’re struggling financially in your business, the government can help you through free government money grants for small businesses.

Almost every small business owner dreams of taking their business to the next level. But it isn’t easy either. The business needs to invest money to hire more employees, but it’s unclear how they will get the money or who will invest in their business.

Moreover, if they got the money on a loan, they would also have a problem if they didn’t repay it on time if they got money on a loan.

Those who own small businesses and need support for their businesses can look for Free Government Money Grants For Small Business. This is because the grant money was free, and you did not have to repay it. This will give you a better chance to make your business better by utilizing the money. T

his article shows that various sources provide Government Money Grants For Small Business. It only takes a few minutes to read the article and learn how to get Government Money Grants For Small Business from those sources. Check for all kinds of grants and resources that can benefit your business by reading on.

Without further delay, let’s get started.

Table of Contents

What Is A Small Business Grant?

A small business grant is money given by a government or organization to an entrepreneur or business owner for a specific purpose. The money is considered a gift, and recipients don’t need to repay it. They should factor in the possibility of paying taxes on the amount awarded before applying. Small businesses can obtain funding through grants to advance a particular program or initiative, such as improving operations, expanding the team, or establishing another location.

How Does A Business Grant Work?

The steps and criteria for applying for a business grant depend on the type of funding you’re seeking.

Ensure your business meets all requirements before applying for Government Money Grants For Small Business. If you plan on covering payroll costs or other operating costs or eliminating debt, it may not be suitable for funding.

You should also know the time involved in applying for different grants. You may be required to submit a lot of paperwork detailing your business’s reasons for applying, the demographics of your market, or the nature of your product. The additional documentation may include details on your finances, marketing, and purposes of using the funds.

You can find countless funding opportunities, including the following:

- Small Business Administration (SBA) of the United States

- Grants.gov

- State Trade Expansion Program (STEP)

- The Minority Business Development Agency (MBDA)

- The Amber Foundation

- The Hope Operation

- Small Business Innovation Research (SBIR) programs

- Small Business Technology Transfer (STTR) grants

Although Government Money Grants For Small Business are typically not required to be repaid, they are often taxable. Details about tax payments are usually noted on the business grant agreement. The funding organization may also provide tax information if it is not explicitly stated in the agreement. Furthermore, the Internal Revenue Service (IRS) and state Departments of Revenue provide information on tax obligations.

As a general rule, a portion of grants should be set aside for taxes. A clear set of financial records can assist you in preparing. Your business may also qualify for tax deductions on business grants, which could be beneficial if they are applicable to you.

Loans vs. Grants: What’s The Difference?

Loans and grants are both sources of funding for small businesses. How do grants and loans differ? The first thing you need to know about grants is that they are free of obligation as long as you follow their terms. The difference between a loan and a credit card is that with a loan, the lender must receive payment in full plus interest.

There is also a difference in the application process. The main consideration for a loan servicer is your ability to repay the loan, not whether you qualify for grants or loans. When deciding whether to lend you money, a lender will consider personal and business credit scores as well as your revenue, years in business, and other business and financial documentation.

If you apply for a small business grant, it may ask for similar financial information, but it will also analyze your business’ merits and eligibility. Generally, grants have eligibility requirements based on location, size, and industry. The business may also have to be owned or operated by women, members of underrecognized groups, or members of a specific organization.

Types of Free Government Money Grants For Small Business

The following are five Government Money Grants For Small Business owners.

National Institutes of Health Grants

National Institutes of Health (NIH) invests more than $32 billion a year in biomedical research around the globe to improve health and reduce disability and illness. The number of grants available currently is thousands.

The NIH is currently awarding grants to biomedical technology businesses for COVID-19 research. The grants provide small businesses with the opportunity to develop cutting-edge COVID-19 solutions.

Small Business Innovation Research Program (SBIR)

The SBIR program provides funding specifically for small businesses engaged in technology research and development. There are two phases of funding available to small businesses: Phase I offers $250,000, and Phase II offers $1.5 million.

USDA Rural Development Business Grants

The Department of Agriculture provides grants and loans to help people and to create jobs. Therefore, they support and assist businesses in rural areas so that quality jobs can be created. Furthermore, it funds community projects, such as the development of housing and community facilities.

Department of The Interior Grants

There are several grants available through the Department of the Interior for small businesses. Among the departments may be the U.S. Fish and Wildlife Service, Indian Affairs, and National Park Service. In addition to these, you can find lots more grants under DOI by visiting Grants.gov.

Small Business Technology Transfer Program (STTR)

The STTR program is similar to the SBIR program but requires small businesses to collaborate with a nonprofit institution. A for-profit company cannot be majority-owned by a venture capital firm to qualify for STTR grants.

Minority Business Development Agency Grant

You may qualify for Government Money Grants For Small Business from the Minority Business Development Agency if you own a minority-owned small business. Additionally, the MBDA provides small businesses with loans, resources, and consulting services.

You can start by finding an MBDA Business Center, a Specialty Center, or a Project near you. You can search for MBDA programs by name, type, and state.

State Trade Expansion Program (STEP)

As of 2011, STEP grants have assisted thousands of small businesses in acquiring grants and navigating the global marketplace. The program awards awards to U.S. states and territories to enable small businesses to overcome obstacles to exporting.

A STEP grant encourages businesses to expand and reach global markets with the help of their local state or territory.

Department of Energy Grants

The DOE offers grants through its SBIR and STTR programs. The DOE offers grants for research and development benefited technology developed by universities or national laboratories. If you want to get a grant from them, you can check here to learn when the grants will be available.

Department of Defense Grants

A grant program is offered by the Department of Defense (Department of Defense) for small businesses. Additionally, they offer grants through the STTR program. A number of initiatives have been initiated, including the Office of Naval Research, the Defense Enterprise Science Initiative, the Air Force Office, and the Army Research Institute. The goal of all of these initiatives is to research and develop technology that will help them reach their objectives.

Department of Justice Grants

There are also grants for law enforcement, public safety activities, programs aimed at improving the criminal justice system, and many more. The Department of Justice Grants program offers grants and support in all these areas.

How To Get Free Government Money Grants For Small Business?

All kinds of organizations offer Government Money Grants For Small Business owners with all kinds of values, missions, and functions. You should consider these key points when applying for small business grants for your startup if you’re just starting out:

Check Your Industry Grants

You can narrow your search for small business grants by focusing on organizations and research institutions in your particular industry. Additionally, focusing on a single industry can enable you to build connections with industry figures and provide guidance and investment opportunities.

Eligibility Requirements

There is no doubt that it is easy to overlook aspects of grant eligibility requirements and end up applying for Government Money Grants For Small Business. You should carefully read the grant requirements and determine whether you qualify. If you are not sure whether you may qualify, speak with someone from the organization.

Align Business With The Organization’s Mission

Organizations that provide Government Money Grants For Small Business do so to accomplish a specific goal. Consider how your business model contributes to achieving this goal. The answer might be hard to parse, so you might be better off applying with another organization.

Spend The Grant Money Wisely

There are some organizations that stipulate allowable expenses for grant money. However, even if they don’t, it’s still important to plan how you’ll use the funds. Your business plan and an understanding of how the money will be spent will help an organization understand your business’ alignment with its mission when determining whether to grant you a grant.

A business plan can often be used to get financing, but plenty of entrepreneurs find it valuable even if they don’t involve investors.

Make A Pitch About Innovation And Expansion

Government Money Grants For Small Business are typically awarded to innovative, forward-thinking, and growing for-profit businesses. Make your pitch about how you plan to scale, any new technologies you might be developing, and how your business can assist the organization.

Keep Your Promises

As small business grants are not loans, lenders do not expect to be reimbursed. They aren’t investment capital, so issuers don’t expect to own your business assets. However, small business grants come with expectations and incentives.

Although issuers don’t expect a monetary return on investment, they still expect one. Government Money Grants For Small Business organizations like these want their grant applicants to feel confident that their business idea contributes to their organization’s mission—whether it’s a common good, an innovation in a particular industry, or economic growth in a particular community.

The money you receive from a small business grant isn’t necessarily free money. The grant issuers often restrict how the funds can be used, sometimes even spending their funds on specific resources they believe will benefit your business.

How To Apply For Government Money Grants For Small Business?

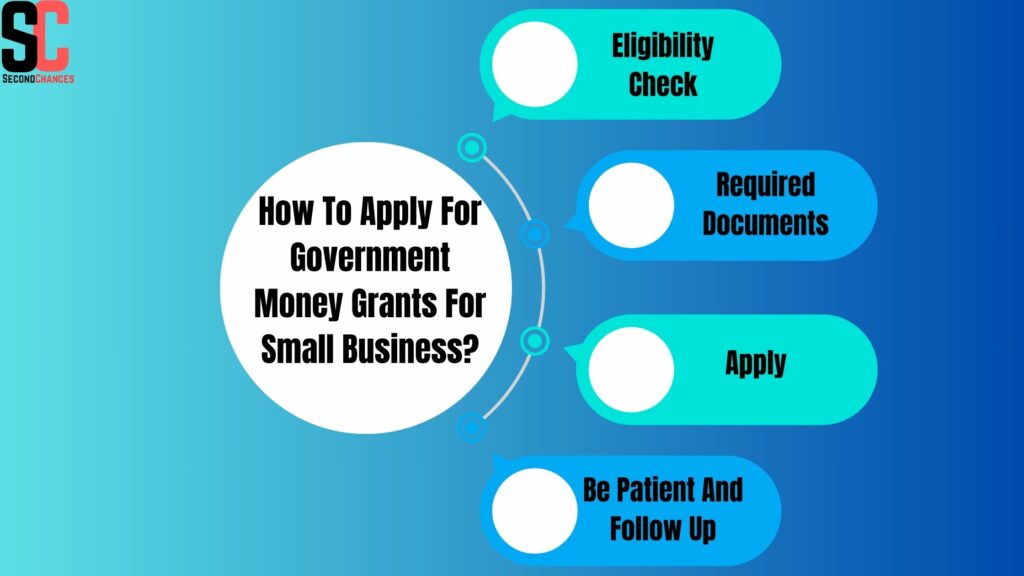

The time you spend developing your business grant application is well worth it. The process will vary based on the grant and donor, but generally speaking, you should expect to follow the following steps:

Eligibility Check

The organization issuing the grant will have specific objectives for what the money must be used for, as well as requirements for eligible businesses. You should carefully review these criteria before doing anything else and contact the grant administrator if you need clarification.

Required Documents

The majority of grant applications require you to submit supporting documents. It will depend on the specific grant and the requirements outlined in the grant that will determine what information you need. Many applications will also ask for a business plan, a current budget that shows how the grant will fit into the business, and a justification for the grant. Additional information that might be required for a grant application includes:

- An employer’s identification number (EIN)

- A brief history of revenues

- Organizational chart, including the number of employees

- Bank statements

- The tax return

- Your current business contracts

- Location(s)

- Contact information

Apply

There are many donors who offer small business grants through an online application process. The online application platforms for different donors are different, meaning that the application process and time required to submit for one grant can be completely different from another. Additionally, you may have to provide specific business documentation and answers to questions about your business.

Be Patient And Follow Up

The decision on which business will receive a grant can take months, so be patient. During this time, you can track your application on websites such as grants.gov. You may also need to follow up with the donor to inquire about the status of your application.

Federal Government Money Grants For Small Business

The government is one of the largest sources of business grants, supporting various enterprises from environmental conservation to child care. While applying for federal business grants can seem intimidating, they can be a great opportunity for entrepreneurs.

Grants.gov

There are many Government Money Grants For Small Business, such as those administered by the Education and Veterans Administrations, are available through Grants.gov.

Small Business Innovation Research And Small Business Technology Transfer programs

STTR and SBIR grant programs focus on technology innovation and scientific research. Through the programs, entrepreneurs can access federal business grants and contracts from 12 government agencies. The business must be for-profit, have no more than 500 employees, and meet other eligibility requirements.

USDA Rural Business Development Grant

USDA’s Rural Business Development Grant program provides funding to assist rural communities in strengthening and growing their small businesses.

There must be less than 50 new employees, less than $1 million in gross revenue, and the business must be located in a rural area. Applicants must apply through the USDA Rural Development offices in their state or locality once a year.

Program For Investors In Microentrepreneurs

Small businesses are not typically eligible for grants from the U.S. Small Business Administration (SBA). However, the Program for Investors in Microentrepreneurs (PRIME) provides federal grants to organizations assisting microenterprises with their businesses.

Regional Government Money Grants For Small Business

Government Money Grants For Small Business are also available locally and at the state level since federal grants are particularly competitive and limited. Here are some options to get you started:

Economic Development Administration

The U.S. Economic Development Administration provides business grants, resources, and technical assistance to communities to support economic growth and encourage entrepreneurship and innovation.

Small businesses can find financing (including grants from the state or regional government), find locations, and hire employees through their state’s agency. The economic development directory lists regional offices and local resources.

Small Business Development Center

The Small Business Development Center (SBDC) in your area provides assistance to small businesses and entrepreneurs. They’re typically affiliated with local universities or a state’s economic development agency, and many can connect you with small-business grants, as well as other funding opportunities – as well as counseling, training, and technical assistance.

Minority Business Development Agency centers

The MBDA operates numerous business centers to promote and grow minority businesses. The centers assist business owners in securing contracts, accessing capital, and competing in emerging markets.

Your local MBDA center can assist you in applying for federal, state, and local business grants and debt-based financing. Usually, the agency holds a small-business grant competition every year and posts contest updates online.

State Trade Expansion Program

SBA funds state Trade Expansion Program (STEP) grants to assist state governments in expanding state-based trade.

Depending on your state, you may be able to use these government small-business grants for various purposes, including participating in export trade shows, designing international marketing products, and supporting website globalization.

Small Business Hardship Grants

A small-business hardship grant may help your business recover after a natural disaster or public health crisis. Various sources may provide these grants, including the government, nonprofits, and corporations.

It’s especially important to check the deadlines for certain business hardship grants as they may only be available during certain time periods.

The following are some options to consider:

State And Local Small-Business Recovery Grants

The government can be a great source of small-business hardship grants, emergency business loans, and other financial relief and assistance options. The COVID-19 pandemic, for instance, caused states and cities to create grant programs that helped small businesses.

Furthermore, some states and cities offer small-business grants to assist businesses that suffer damages from disasters like fires, floods, and hurricanes.

Etsy Emergency Relief Fund

The Etsy Foundation partners with the nonprofit organization CERF+ to provide financial relief to its sellers affected by disasters. The small-business hardship grant is available to Etsy sellers who have experienced a federally declared natural disaster within the last year and have an active Etsy seller account.

Etsy Emergency Relief grants range from $2,000 to $5,000. The program accepts applications on a rolling basis, and funds are issued on a quarterly basis.

DoorDash Restaurant Disaster Relief Fund

The DoorDash Restaurant Disaster Relief Fund may be able to provide small-business recovery grants to restaurants affected by natural disasters. A $10,000 business grant is available to brick-and-mortar restaurants impacted by a federally or state-declared disaster, such as a wildfire, hurricane, or earthquake.

Additionally, you must operate three or fewer restaurants, have 50 or fewer employees, have been in business for at least six months, and earn $3 million or less per location.

A disaster declaration must be issued within 12 months from when applications are accepted every quarter. Applicants will be notified within 30 days of the application deadline. A recent application cycle concluded in March 2024.

Small Business Readiness For Resiliency Program

This program is meant to assist small businesses with preparing for and recovering from unexpected disasters. The R4R program requires you to complete a preparedness checklist (including an emergency action plan), register in the database, and apply for a grant in the event of a disaster.

The maximum grant amount is $5,000, and you must show that you incurred disaster-related damages or losses equal to or greater than that amount. This small-business hardship grant requires you to have fewer than 500 employees, among other requirements.

Binc Foundation Emergency Financial Assistance Grants

The Binc Foundation provides small-business hardship grants to bookstores, booksellers, and comic store owners who face unforeseen financial hardships. A qualifying event must occur within the United States or one of its territories, such as a natural disaster, a man-made disaster, a serious medical expense, or domestic violence.

The Binc Foundation website offers an inquiry form that you can fill out at any time to gain access to emergency assistance.

How To Use Free Government Money Grants For Small Business?

Many people wonder how to get funding for a small business when they are thinking about starting one. One option is to apply for Government Money Grants For Small Business. The government usually provides grants to help businesses get started or grow.

There are many different kinds of grants, and each one has its own eligibility requirements. The first step to getting started is to research which grants you might be eligible for and then apply for them.

Purchase Equipment Or Inventory

The best way to utilize grant money is to invest it in your business. The funds can be used to buy new equipment or inventory, and this will allow you to start and grow your business.

Hire Employees

You can also use grant money to hire employees. As a result, your business will start on a strong footing, and your workforce will grow.

Market And Advertise

Government Money Grants For Small Business can also be used to fund marketing and advertising campaigns, which will help promote your business and attract customers.

Train Your Employees

If you plan to hire employees with the grant money, you’ll also need to train them. The funds can be used to pay for employee training so they can succeed in their new positions.

Expand Your Business

Lastly, grant money can be used to expand your business. You can use the funds to open a new location or expand an existing one. As a result, you will be able to reach new customers and grow your business.

Follow these tips to grow your small business. Research which grants you qualify for and complete the application process. If you have been awarded a grant, use the funds to grow your business.

Tips To Grow Small Business

Whenever you find the ideal grant for your business, you’ll want to give it the best chance of being awarded that funding. The majority of grants are competitive, so you’ll have to stand out from the crowd. You can do that in a few ways:

- Keep your business plan current and compelling.

- Make your elevator pitch perfect.

- Maintain up-to-date bookkeeping.

- Create an email list or a social media following to help you get votes for your business; some grants require “votes.”

- Understand the motivations of the grantor. The purpose of this grant is to achieve what?

- Make sure you follow the directions exactly.

- Make sure your SCORE mentor or a trusted colleague reviews your application before you submit it.

- Make sure you don’t wait until the last minute! If possible, note deadlines and apply early.

There are several Government Money Grants For Small Business owners available, and the businesses awarded these grants usually show how they will use the funding to solve a business challenge or grow. Your grant application should be presented similarly to how you would present your business to a customer or client.

Beware of Government Money Grants For Small Business Scams

There are some ways to get financial assistance from the government, and there are also grant scams that promise you free money in hopes of stealing it from you. Make sure you don’t fall for it. When the government offers free money, including for starting a business or paying for personal expenses, it never does so through social media. People and families in need are assisted by state and federal programs in order to get on their feet and become self-sufficient.

FAQs For Government Money Grants For Small Business

Is There A Difference Between A Grant And A Loan?

The main difference between a grant and a loan is that a grant does not require repayment. The purpose of a loan is to borrow money and return it with interest over a set period.

What Is The Money You Don’t Have To Pay Back?

Grants are financial aid that doesn’t require repayment (unless you withdraw from school and owe a refund or fail to fulfill your service obligation with a TEACH Grant).

What Are The Benefits Of Getting A Small Business Grant?

A small business grant can help you start or expand a business, reduce your financial risk, and gain credibility with investors and lenders.

Why Do Government Money Grants For Small Business Get Denied?

An application for a grant may be denied for many reasons. Your application may not meet eligibility requirements or demonstrate well enough how this grant will support and develop your business.

Are Government Money Grants For Small Business Taxable?

The majority of grant money, including government grants, is taxable income. Therefore, you’ll usually have to pay taxes on the grant money. A large number of businesses reserve part of the grant money to meet their tax liabilities. Your business grant may be tax-exempt or taxable, depending on whether the terms of the grant agreement and IRS guidelines state so.

How Do You Find Government Money Grants For Small Business?

There are a number of government agencies, state organizations, and private corporations that offer small-business grants. You can start your search by going to Grants.gov, your local Small Business Development Center, and nonprofits like Local Initiatives Support Corp.

What Kind Of Grants Are Available For Small Businesses?

There are several types of Government Money Grants For Small Business, including those offered by the government, such as federal, state, and local grants, as well as grants from nonprofits, corporations, and individuals.

How Do You Qualify For Government Money Grants For Small Business?

The organization awarding the grant will determine the qualifications for the grant. A priority may be given to businesses in rural areas or those with low incomes, as well as to those that women or minority groups run. You need to review the full eligibility criteria before applying for a grant to determine if your business qualifies.

Can I Get Help From The Federal Government Regarding My Small Business?

Yes, the federal government offers assistance to small business owners. A hardship loan can help single mothers support their businesses. Business owners can also receive grants in order to expand their businesses or start new ones. You must also remember that your business must be categorized as a small business and have a limited turnover.

Are COVID-19 Business Relief Grants Still Available?

Numerous small businesses have been affected by the Covid-19 pandemic. The federal government has largely halted the Coronavirus pandemic. Nevertheless, Covid-19 Business Relief Grants are available for small businesses. There are three grants available to help small businesses: the Barstool Fund, GoFundMe’s Small Business Relief Fund, and New York State’s COVID-19 Pandemic Small Business Recovery Grant Program. Those programs have eligibility requirements, so business owners can check them out and apply for the grant.

How Do I Apply For Government Money Grants For Small Business?

The application form is required to apply for any small business grant. Nevertheless, each program has its own application process for getting a grant for your small business. You also need to provide details about your business, and you may have been asked to write a letter or an essay outlining how the funds will be used. Some grants, like FedEx, require video elevator pitches. Therefore, there are different requirements for different small business grants.

How Can I Get Free Money From The US Government?

There is no “free money” offered by the government to individuals. Typically, federal grants are only available to states and organizations. However, there are federal loans available for education, small businesses, and more. You can find assistance with food, health care, and utilities at USA.gov.

Conclusion

As you can see, several grants are available to small businesses. It doesn’t matter what field or industry they belong to. The small business must meet the program’s eligibility requirements to qualify for the grant. Therefore, applicants are encouraged to review the program’s eligibility requirements before applying for the grant if they meet them. There are also Government Money Grants For Small Business that are affected by Covid-19.

Moreover, young entrepreneurs can apply for Government Money Grants For Small Business or startup plans. A grant program provides grants primarily for planning a business’s future. The program will give you a grant if your plan is good, uses advanced technology, and benefits people and the nation. Learn how to use free government money grants for small businesses. Additionally, you can get money from PayPal grants for your business if your project aligns with their funding criteria.