There is no Hometown Heroes Program In Tennessee. In addition, the Tennessee Housing Development Agency (THDA) offers a program called Homeownership for Heroes for veterans, state and local law enforcement, EMTs/paramedics, and firefighters.

Hometown Heroes is a home loan program that helps qualified active-duty military personnel, public guardians, veterans, state and local police authorities, EMTs/paramedics, and firefighters purchase a home in Tennessee.

The program offers various benefits, such as a lower loan cost, a waiver of the prerequisites for first-time homeowners, and the possibility of getting 100 percent of the property’s selling price. Miami has a Hometown Heroes Program Equity Apartments in Miami.

The Hometown Heroes Program In Tennessee gives qualified military faculty and veterans an opportunity to learn about homeownership. Different benefits can simplify the process of buying a house, and Tennessee wants to thank those who serve by offering this program.

The guide will go through the Hometown Heroes Program In Tennessee, its eligibility criteria, and how to apply for it.

So, Let’s get started.

Table of Contents

What Is The Hometown Heroes Program?

Hometown Heroes offers financial assistance to cover the down payment and closing costs of home purchases. The loan amount could be up to $35,000 for eligible borrowers. The Hometown Heroes Program in Florida is only available to first-time homebuyers in the Florida community where they are employed. A down payment assistance program could help cover closing costs, prepaid taxes, insurance escrows, and upfront mortgage insurance premiums.

How Does The Hometown Heroes Program Work?

A program called Hometown Heroes assists first-time homebuyers who live in the community where they work. An interest-free 30-year deferred second mortgage helps with down payments and closing costs.

As a result, borrowers receive upfront assistance without accruing interest. The loan must be repaid if the property is sold, refinanced, transferred, or no longer used as a primary residence. Even though this program does not constitute a grant, it could be very helpful for those looking to own a home in Florida.

Eligibility Criteria For Hometown Heroes Program In Tennessee

Next, let’s look at the eligibility requirements for Hometown Heroes Program In Tennessee:

- Applicants should be current or former military personnel, public gatekeepers, or veterans’ groups.

- An individual from a state or neighborhood police department should apply.

- It would be best if you were a paramedic or EMT.

- You must be a firefighter.

- The minimum credit score is 620 (generally).

- Payments for the home loan should be able to be made consistently.

- Tennessee is a great place to buy a home.

- The highest pay for single borrowers is $100,000, while the highest for married borrowers is $120,000.

Additionally, if you are a first-time buyer, you may qualify for the Hometown Heroes Program In Tennessee. The first-time homeowner requirement does not apply to eligible military personnel or veterans in any part of Tennessee. You can contact THDA at (615) 741-7000 with questions regarding Tennessee Hometown Heroes.

Mortgage Loans You Can Use With Hometown Heroes Program In Tennessee

The Hometown Heroes Program In Tennessee offers a variety of mortgage loans, including FHA, VA, and USDA. Consider the following loan options to find the right option for you.

FHA Loan

Housing of Urban Development (HUD) offers these loans with flexible guidelines for borrowers with low down payments and imperfect credit scores.

USDA Loan

This type of mortgage is government-insured and aims to facilitate home acquisition in rural areas. A USDA loan is available to low—and moderate-income rural borrowers.

VA Loan

There is no down payment required for this loan option, which is partially backed by the Department of Veterans Affairs and is designed for military personnel, veterans, and surviving spouses.

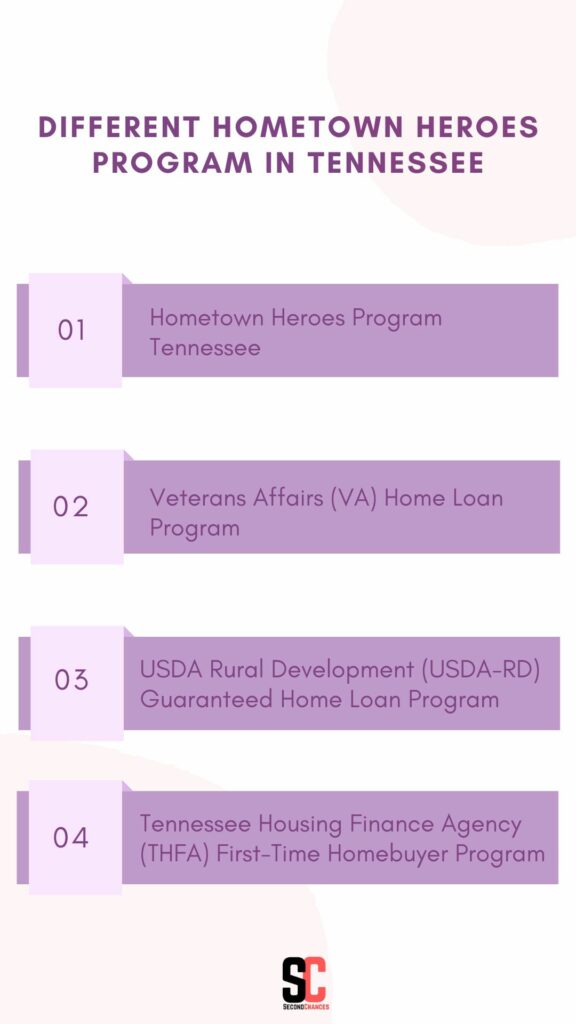

Different Hometown Heroes Program In Tennessee

Hometown Heroes Program Tennessee

The Tennessee Housing Development Agency (THDA) runs the Hometown Heroes Program in Tennessee. The applicant must be an active duty military member, a member of the National Guard, a veteran, an officer of state or municipal law enforcement, an EMT/paramedic, or a firefighter. The eligibility requirements and benefits for various projects may differ. To learn more about the program and determine whether you qualify, you should contact the right organization.

The Tennessee Hometown Heroes Program is one of several programs that provide financial assistance to qualified veterans and service personnel. These programs include:

Veterans Affairs (VA) Home Loan Program

VA home loans offer different benefits to qualified veterans, including no initial installment and credit guarantees. Veterans Affairs Home Loan Program is a contract program that provides a variety of benefits to qualifying veterans, such as:

- There is no down payment required. In the event that you qualify for a VA credit, no upfront payment is required.

- A guarantee backs it. A VA loan guarantees a part of the credit, which makes it more appealing to banks and could result in a lower interest rate.

- The credit criteria should be adaptable. If your credit is less than perfect, you may still qualify for a VA loan due to the VA’s lenient credit standards.

- There is a maximum loan amount. You may be able to borrow more to buy a residence because the VA loan maximum is higher than the conventional loan limit.

The following requirements must be met to qualify for a VA loan:

- The veteran must have served at least 90 days of active duty.

- A decent credit score (620 or higher) is required.

- You must be able to afford the monthly mortgage payments.

- You can apply for a VA loan through a lender who partners with the VA. Your lender will help you find a house that meets your needs and determine your eligibility.

A VA Home Loan Program can help veterans realize their dream of becoming homeowners. The VA offers various perks that make buying a home easier, and it’s a way to show gratitude to veterans.

A few more details about the VA home loan program are as follows:

- The VA oversees a VA home loan program.

- The program is open to veterans who served on active duty for 90 days or more during wartime.

- It provides no down payment, a loan guarantee, and lenient credit requirements.

- A VA loan can have a maximum amount higher than a standard loan.

- You can apply for a VA loan with the help of a partner lender.

The VA offers a VA house loan program for veterans intending to purchase a house. VA can inform you about the advantages and models of the program and help you determine your eligibility.

USDA Rural Development (USDA-RD) Guaranteed Home Loan Program

USDA-RD Guaranteed Home Loans provide borrowers with several incentives, including no initial investment and advance certification.

The USDA Rural Development Guaranteed Home Loan Program is an administration-backed contract that offers different benefits to qualifying country borrowers, including:

- There is no down payment required, and if you qualify, the VA credit won’t require you to make an upfront installment on your home.

- A guarantee secures the loan. A VA guarantee makes the credit more attractive to banks, potentially lowering financing costs.

- The criteria for credit approval should be adaptable. Even if you don’t have perfect credit, you may be eligible for a VA loan due to the VA’s lenient credit standards.

- There is a maximum loan amount. VA loans offer higher loan limits than conventional loans, so you can borrow more.

A VA loan requires you to meet the following requirements:

- The veteran must have served at least 90 days of active duty.

- The minimum credit score is 620.

- You must be able to afford the monthly mortgage payments.

- USDA-RD loans can be applied for through a partnering lender. If you qualify, your lender will assist you in finding the right house for you.

The USDA-RD Guaranteed Home Loan Program offers rural borrowers a great opportunity to purchase a home. The USDA’s Home Loan Program offers a variety of incentives to assist in the home-buying process, and it’s a way to express gratitude to the communities it serves.

There is additional information regarding the USDA-RD Guaranteed Home Loan Program here:

- USDA-RD manages the USDA-RD Guaranteed Home Loan Program.

- The program is available to borrowers who buy a home in a rural area.

- Program requirements include no down payment, loan guarantees, and lenient credit requirements.

- USDA loans have a higher ceiling than conventional loans.

- A cooperating lender may be able to provide a USDA-RD loan.

The USDA-RD Guaranteed Property Loan Program may be of interest if you’re looking to buy a rural property. If you are interested in learning more about the perks and criteria of this program, you can contact the USDA to determine your eligibility.

Tennessee Housing Finance Agency (THFA) First-Time Homebuyer Program

THFA has a First-Time Homebuyer Program that assists first-time homebuyers with their initial payments and closing costs. A first-time homebuyer can receive assistance with their closing costs and initial installments through the Tennessee Housing Finance Agency (THFA). A program is being offered to encourage first-time homebuyers to overcome monetary obstacles.

In order to qualify for the THFA First-Time Homebuyer Program, you must meet the following criteria:

- Buying your first home is a good idea.

- The credit score must be at least 620.

- It should be reasonable for you to pay monthly installments under the contract.

- Tennessee is a great place to buy a home.

- If you are eligible for the THFA First-Time Homebuyer Program, you can apply for assistance through a participating bank. Your bank will determine your eligibility and help you find a house that meets your needs.

THFA’s First-Time Homebuyer Program offers first-time homebuyers an excellent opportunity to explore their desire to become homeowners. A variety of advantages are available through the program, and it is a way for THFA to communicate its support for first-time homeowners.

The THFA’s First-Time Homebuyer Program is described here:

- The THFA administers a First-Time Homebuyer Program.

- Tennessee first-time homeowners can apply for the program.

- A down payment and closing cost assistance program is available through the program.

- The amount of help you can receive depends on your income and the cost of the home.

- You can apply for THFA First-Time Homebuyer Program support through a participating lender.

In Tennessee, THFA offers First-Time Homebuyer Programs for first-time homebuyers interested in purchasing a home. THFA can assist you in determining your eligibility for the program and provide additional information about the benefits and conditions. To get help with your debt, you might find the National Debt Relief Program helpful.

Benefits of The Hometown Heroes Program In Tennessee

First-time homebuyers can benefit from the Hometown Heroes Program. The program can assist with down payments and closing costs up to 5% of the loan amount. Several factors beyond household income are considered when determining income eligibility.

The assistance comes with zero interest, so long-term savings can be realized. Additionally, the program functions as a deferred second mortgage, which means homeowners won’t have to make monthly payments for 30 years, resulting in greater financial autonomy.

Where To Find Home-buying Help In Tennessee?

There are several organizations mentioned above that offer free advice to first-time homebuyers in Tennessee and surrounding areas. Check your eligibility for home ownership in Tennessee, including options for low income housing with no waiting list in Tennessee. Besides our selection, the HUD offers a few lists of regional, state, and local resources.

Statewide first-time home buyer resources in Tennessee

- The Tennessee Housing Development Agency (THDA) maintains a list of courses approved for homebuyer education. Furthermore, you’ll find participating lenders, income and purchase price limits by county, and a Handbook for Homebuyers to download

- The THDA offers low- and moderate-income borrowers a variety of homeownership programs. There are some programs that offer down payment assistance.

- The Tennessee Housing Development Authority offers a housing voucher program (Section 8) to help Tennessee residents become homeowners. Those who meet the guidelines may be able to purchase houses with Housing Vouchers or obtain hotel vouchers for homeless in Tennessee.

- The Housing Assistance Council NeighborWorks program provides down payment and closing cost assistance to Tennessee homebuyers and homeowners.

- Through its assistance programs, the Tennessee Association of Community Action may be able to help you obtain housing goals, counseling, weather-proofing assistance, and emergency funding.

There is also a list of resources on HUD’s website for first-time homebuyers in Tennessee, including:

- The Nashville Metropolitan Development and Housing Agency offers down payment and closing cost assistance.

- In and around Nashville, Affordable Housing Resources (AHR) offers homeownership assistance programs.

- The Division of Housing and Community Development of the City of Memphis provides housing assistance and provides downloadable information.

- The City of Knoxville offers down payment assistance and closing cost assistance.

- The Chattanooga Neighborhood Enterprise (CNE) offers first-time homebuyer assistance in Tennessee.

FAQs For Hometown Heroes Program In Tennessee

How Much Income Does The Down Payment Assistance Program Accept?

A down payment assistance program’s income limit varies depending on the provider and location. These programs are usually targeted at low- and moderate-income individuals and families. The specific income limits for each program can vary by state, city, and county.

What Happens If You Don’t Have Enough For A Down Payment?

If you do not have enough cash for a down payment, consider low down payment mortgage options available through the FHA, USDA (for rural properties), or VA (for veterans). There are many state and local government programs that offer down payment assistance. The mortgage calculator can provide you with an idea of how much home you can afford, while real estate agents and loan officers can offer you tailored recommendations.

Are The Hometown Heroes Program In Tennessee Genuine?

Tennessee’s Hometown Heroes Program is genuine. The website Hometown Heroes Program in Tennessee provides information about the Hometown Heroes Program in Tennessee.

Can I Combine The Benefits of The Hometown Heroes Housing Program With Other Homebuyer Assistance Programs?

Yes, Hometown Heroes Housing Program assistance can be combined with other eligible programs. Nevertheless, each program will have its requirements that you must meet. As a result, make sure you understand the requirements of any program before applying.

Am I Eligible For The Hometown Heroes Program In Tennessee?

The Tennessee Hometown Heroes Program is open to first-time homebuyers with a minimum credit score 620.

Conclusion

The Hometown Heroes Program In Tennessee offers qualified military personnel and veterans the chance to become property owners. There are several benefits to the program that can simplify buying a house, and it is a way for Tennessee to thank those who serve.