What is the Hometown Heroes Program? How To Start A Hometown Heroes Program? What are the benefits of the Hometown Heroes Program? If these are your questions, then don’t worry. You have landed on the right page.

This program is a great way to make your community more livable by assisting people in purchasing homes. By following these instructions, you can make a significant difference in the lives of many people.

The Hometown Heroes Program is an excellent way to assist community members and employees with their property purchases. A down payment and closing cost assistance program makes it more affordable for qualifying homebuyers to acquire a home. Besides that, there is an Advantage Approval Program that offers homebuyers great assistance.

The process of Start A Hometown Heroes Program can be challenging, but it is ultimately rewarding. There is a possibility that you will establish a program that will have a positive impact on many people’s lives.

Here are instructions on How To Start A Hometown Heroes Program.

Table of Contents

What Is The Hometown Heroes Program?

The Hometown Heroes program provides financial assistance for down payments and closing costs. The maximum amount the borrower can receive is 5% of the loan amount, up to $35,000. A first-time homebuyer is eligible for this program. You may be eligible for assistance with down payments, closing costs, taxes, and insurance escrows.

How Does The Hometown Heroes Program Work?

The Hometown Heroes program assists first-time homebuyers who wish to purchase a home in their community of employment. An interest-free 30-year deferred second mortgage helps with down payment and closing costs.

Through the Hometown Heroes Program, a borrower receives upfront assistance without incurring interest. If you’re in Miami, you can also explore the Hometown Heroes Program Equity Apartments. If you are planning to sell the property, refinance, transfer ownership, or no longer use it as a primary residence, then you must repay the loan.

Eligibility Requirements To Start A Hometown Heroes Program

The eligibility criteria for the Hometown Heroes program have changed over time. Homebuyers must meet the following criteria to qualify:

- To qualify, buyers must work at least 35 hours per week for a Florida-based employer. There are additional documentation and requirements for self-employed borrowers.

- A borrower who owned a primary residence in the past three years is ineligible for a first-time homebuyer loan.

- The buyer must live in the home they are buying as their main residence within 60 days of closing.

- The property types allowed here include single-family residences, townhouses, condos, villas, and structures with 2-4 units. There are adjusted qualifications for manufactured homes.

- Borrowers must attend a course approved by the Homebuyer Education program.

- The buyer must have a credit score of at least 640.

- A borrower’s debt-to-income ratio must be below 50% in order to be approved.

- The borrower must meet certain income requirements. They must earn a median income of less than 150%.

- A participating lender is required for homebuyers to work with Florida Housing.

- There are some exemptions for veterans and active-duty personnel. Active Military borrowers should contact their lenders for more information.

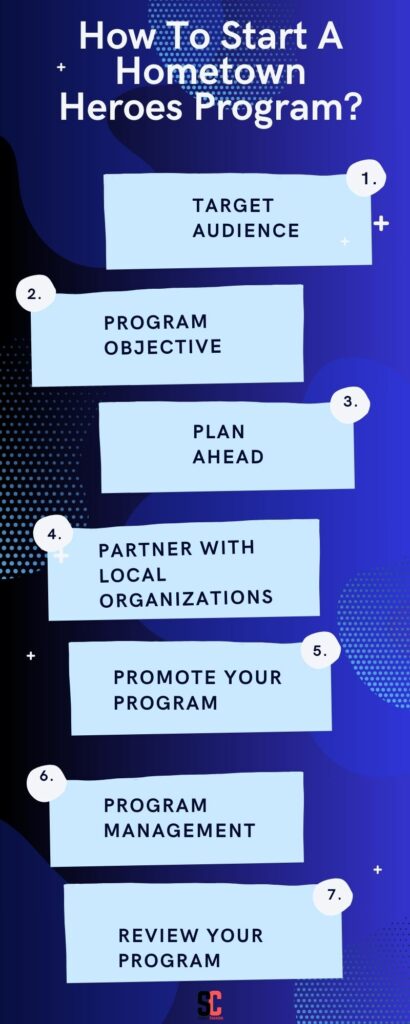

How To Start A Hometown Heroes Program?

You can Start A Hometown Heroes Program in your community by following these steps:

Target Audience

Who are your community’s hometown heroes? The list may include emergency responders, teachers, nurses, military personnel, and other critical employees.

Program Objective

How do you expect your program to achieve its goals? Is it your goal to assist more people in your neighborhood purchase homes? Are you interested in increasing homeownership rates among certain demographic groups?

Plan Ahead

What steps will you take to implement your program? Which methods will you use to locate and contact qualified homebuyers? What are your plans for funding your program?

Partner With Local Organizations

The Hometown Heroes Program can be a great opportunity for collaboration with many organizations in your community. This category includes local governments, banks, credit unions, real estate agencies, and non-profit organizations.

Promote Your Program

You can inform your neighborhood about the Hometown Heroes Program. Your program can be marketed through print and digital advertising, social media, and public events.

Program Management

After you have identified qualified homebuyers, the next step is to administer the program. This process involves accepting applications, sanctioning loans, and assisting with closing costs and down payments.

Review Your Program

It is important to assess the effectiveness of your program after it has been in place for some time. This will help you determine whether your program is succeeding and whether any changes need to be made.

Tips To Start A Hometown Heroes Program

A Hometown Heroes Program can be rewarding and challenging at the same time. The following instructions may help you Start A Hometown Heroes Program that will improve the lives of many.

You can write a guide for the Hometown Heroes Program in the following ways:

- Start with a hook that piques the reader’s interest.

- Explain the importance of the Hometown Heroes Program.

- A Hometown Heroes Program offers many benefits.

- Tell us how previous Hometown Heroes Programs have benefited people.

- Engage the reader by establishing a Hometown Heroes Program.

How To Apply For The Hometown Heroes Program?

Follow the given instructions to apply for the Hometown heroes program:

- The first step to applying for the Hometown Heroes Program is to locate an approved lender.

- Direct Mortgage Loans are an approved lender that can assist you with the preapproval application and verify your eligibility.

- The next step will be to complete a Homebuyer Education Course once you have been preapproved.

- After completing the course, you’ll need to work with a Real Estate Agent to find a home and make an offer.

- Lastly, the closing process must be completed.

Benefits of The Hometown Heroes Program

The Hometown Heroes Program offers several advantages to qualified homebuyers, including:

Down Payment Support

A qualifying property owner can receive an upfront installment assistance of up to 5% of the underlying home loan credit sum. As a result, you may be able to set aside less money for an initial investment, thereby making homeownership more accessible to you.

Closing Cost Aid

Additionally, qualified homebuyers may receive up to $1,000 in closing cost assistance. This can resolve the underlying purposes of buying a home, such as evaluation, title protection, and recording fees.

Lower Interest Rates

In some cases, qualified home buyers can qualify for a loan with a lower contract rate. As a result, your monthly contract installments will be decreased.

A Tax Advantage

A qualified home buyer may be able to claim all charge benefits, such as a deduction for contract interest and local charges. As a result, you may get a good deal on your entire accommodation bill.

Apart from monetary compensation, the Hometown Heroes Program also offers the following advantages:

- The knowledge that you are sponsored by a program such as Old Neighborhood Legends may provide you with an inward sense of peace.

- Hometown Heroes offers a variety of educational and resource opportunities to help you prepare for homeownership. The workshops will cover topics such as finance, budgeting, and household maintenance.

- The Hometown Heroes Program is intended to help you connect with other first-time homeowners and develop a sense of community. The process of buying a home can seem confusing to someone new to the area or unfamiliar with it.

Hometown Heroes may be an excellent resource for first-time homebuyers who qualify. The program offers various financial and non-financial rewards to assist you in achieving your dream of owning a home. States also offer a variety of Hometown Heroes programs.

FAQs About How To Start A Hometown Heroes Program

What Is A Hometown Heroes Program?

The Hometown Heroes Program provides down payment assistance to homebuyers. However, homebuyers must meet the eligibility requirements to qualify. This program aims to help communities build homes.

What Are The Income Requirements For Hometown Heroes In Florida?

The income requirements for the Hometown Heroes program in Florida are that the household’s income must be less than 150% of the area’s median income. The gross income cap for Hometown Heroes starts at $128,250 in Florida and goes up to $162,750 in high-cost counties.

Does Hometown Hero Check ID?

As required by federal and state age verification laws, we use third-party age verification systems to verify users’ ages, which may include collecting photo IDs.

Is It Easy To Start A Hometown Heroes Program?

The process of Start A Hometown Heroes Program requires several steps, such as identifying your target audience, researching existing programs, securing funding, developing a marketing plan, and much more. As a result, the difficulty varies depending on the program’s requirements.

Conclusion

The Hometown Heroes Program is an excellent way to give back to your community. If you’re interested, you can also apply for the Hometown Heroes Program in Tennessee.

If you can contribute a down payment and closing cost assistance to your employees and other community members, you may be able to help them realize their dream of homeownership.