Are you searching for Rent To Own Cars No Deposit Near Me? This is the end of your search.

Normally, you can rent furniture, appliances, and electronics, but have you ever considered renting cars for people?

There are some differences between these deals and your typical car lease. There could be many cars on a lot that you can purchase with no credit check and little down payment from Rent To Own Cars dealership rather than focusing solely on new cars.

Similarly to other rent-to-own items, your monthly payments will go toward the purchase price. The Car will be yours once the final payment has been made, and it will be free and clear.

Here is all the information you need about Rent To Own Cars No Deposit Near Me, how it works, and how to get them.

Let’s begin without wasting any time.

Table of Contents

What Are Rent To Own Cars?

An individual can rent a car to own it if they sign a specific contract with them. When you rent a car, you pay for it as if you were renting, but instead of returning it at the end of the term and losing money, you use some or all of your rent to purchase your own Car.

How Rent To Own Cars No Deposit Near Me?

A rent-to-own agreement allows you to have access to a wide range of high-quality and reliable cars. A rent-to-own arrangement allows you to rent a car for a weekly fee, and you can then purchase the Car after about two years (though this may vary). As you pay rent over time, it gradually builds up and will contribute to your eventual car purchase. The rental agreement does not require a credit check or deposit since it is not a loan or lease. The weekly rental payments cover all costs.

The rent-to-own providers still conduct their own checks on your identity and finances to ensure you can afford repayments. In recent years, this has become a popular way to acquire a car without obtaining a loan.

How Rent To Own Cars Works?

Payments for Rent To Own Cars are often made weekly rather than monthly and depend on the Car’s price. A down payment is probably also required.

Rent To Own Cars is much like a leasing agreement, except that a portion or all of the payments go toward the final purchase price.

In most cases, you make payments directly to the dealership. Payments may be managed through a national bill-pay service if you buy from a large chain. Late payments usually incur a $25 fee.

The subprime market is usually served by car dealers that offer rent-to-own options. The cars they sell tend to be mechanically sound and have higher mileage. They sell these cars at a significant premium. Rental prices are calculated based on that base price.

Requirements For Rent To Own Cars No Deposit Near Me

Rent To Own Cars can be leased from a dealership with an in-house financing department. Nevertheless, a rent-to-own agreement is not a loan. A lender does not provide you with money to purchase a car.

A dealer determines the amount you need to pay to own the Car, which is then paid either weekly, biweekly, or monthly. All installment payments and down payments go toward the Car’s selling price, although some dealers may ask for a large final payment. The Car is yours once you’ve paid off everything you owe.

There are typically a few requirements for renting a car to own:

- Driver’s license must be valid

- A 30-day check stub is usually sufficient as proof of income

- Utility bills in your name are usually sufficient proof of residence

- The amount of the down payment depends on the Car.

There was no credit score requirement listed. A BHPH dealership that offers Rent To Own Cars arrangements may not run a credit check! The Rent To Own Cars can be an option for poor credit borrowers.

Rent To Own vs. Subprime Loan vs. Leasing

There is one major difference between a regular lease and a rental agreement: who owns the Car after the lease ends? You usually keep a leased car after the rental period ends. A car leased on a lease is actually rented for the period of the lease. A monthly fee and interest are added to the payment for wear and tear on the Car.

In the end, when you lease a car, you no longer own it, but you can either buy it, begin a new lease for another car or simply walk away. Leasing a car requires the dealership to check your credit, as opposed to buying one. You can get a lease, and how much your monthly payment will be based on your credit score.

Your monthly payments and interest rates will decrease significantly with subprime loans. You can still get a loan even if you have bad credit. You also risk having your Car repossessed. Since rent-to-own does not require a credit check, your credit is protected and does not suffer any damage.

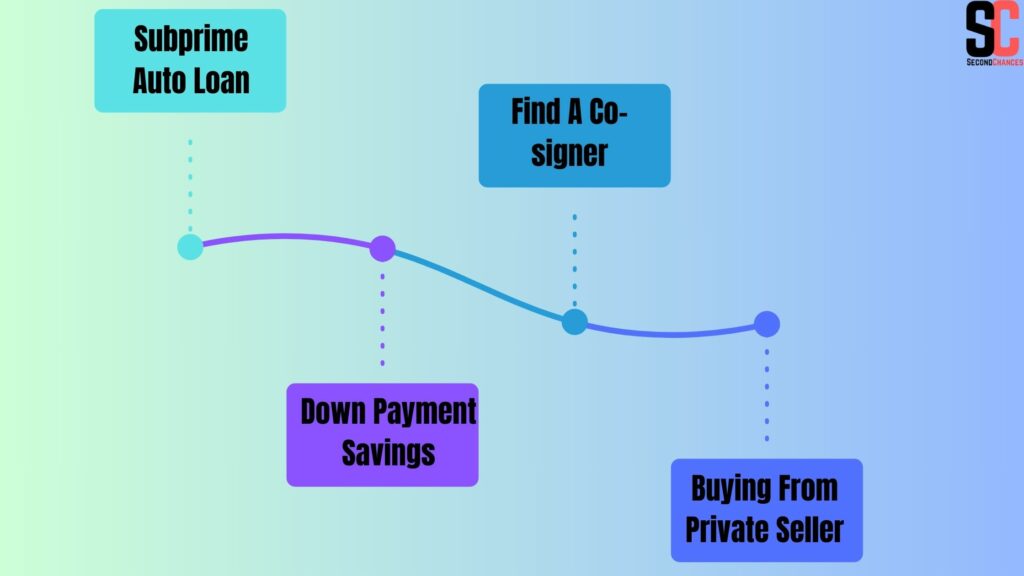

Alternatives For Rent To Own Cars No Deposit Near Me

However, you may still have options other than renting to own.

Subprime Auto Loan

A lot of traditional banks, credit unions, and online lenders offer subprime auto loans to borrowers with less-than-perfect credit (the term “subprime” describes loans that are taken out by people with below-average credit scores). The downside of subprime loans is that they usually come with much higher interest rates, which increase the cost of borrowing.

Find A Co-signer

You can find a co-signer by asking a family member or friend to commit to paying back your loan if you can’t. Co-signers with good credit may have a greater chance of getting you approved for a conventional auto loan.

Down Payment Savings

Save some money for a down payment on a car if you can wait. In addition to increasing your loan approval odds, a down payment may even result in a lower interest rate on your auto loan. Furthermore, some churches that help with car payments may offer assistance programs or financial resources to support individuals in need of financial aid for purchasing a vehicle.

Buying From Private Seller

The option of buying a used car outright from a private seller or car auction could allow you to avoid financing altogether.

What Makes Rent To Own Cars Different?

There is a major difference between rent-to-own and leases or loans. Credit scores or histories aren’t taken into account when deciding whether a customer is eligible to rent or own.

Residents living in Perth with no credit history or poor credit history have the option of renting or owning a home. Many students and young adults have irregular incomes, are studying full-time, or are enrolled in apprenticeships, which makes obtaining major credit such as car loans and leases more difficult. A car may seem unaffordable to people just entering the workforce or finishing tertiary education. The lack of credit history may also prevent new arrivals from obtaining credit.

There may also be difficulty finding car lenders who accept pensioners and Centrelink recipients. Some banks and lenders don’t consider Centrelink payments to be income.

Those who have been refused a car loan and advised they may qualify for a bad credit car loan may face enormous interest rates – sometimes as high as 25%p.a. 40%p.a. The comparison rate includes all fees and charges. The rent-to-own system in Perth does not charge interest on any payments because it is not a loan. There is one weekly rental charge that includes all fees, charges, and other costs.

Does Rent To Own Cars Purchase Require A Credit Check?

Typically, Rent To Own Cars dealerships won’t require a credit check. This is because you are technically renting the Car until your last payment is made. As a result, if you fail to make a payment, the dealer is more likely to regain possession of the vehicle.

A modified rental agreement will be signed instead of a traditional credit check to allow you to take ownership of the Car after you make the final payment. Payment amounts and number of payments will vary depending on the dealer and the value of the Car you’re renting.

Also, your dealer will determine whether a down payment is required when you take possession of the vehicle. You will not always be required to put money down with a dealer, but some may charge a processing fee for your application. An origination fee is sometimes called this.

Subprime auto loans may be an alternative to avoiding a credit check if you appear to have no financing options.

Poor credit car financing lenders can customize a loan package to meet your interest rate and payment requirements. Plus, you’ll have access to a larger selection of cars. Your credit report can be improved with on-time payments and warranties.

What Types of Cars are Available For Rent Or On Their Own?

There are a variety of makes and models to choose from. The range of vehicles ranges from compact cars to people movers with eight seats. Cars range from sedans to SUVs, coupes to hatchbacks to wagons, and light commercial vehicles like vans and utes. There may not be a model that suits you right now, but check back soon, as the list is always updated. There are cars all over Australia. A car can be picked up from Sydney, Melbourne, Brisbane, Gold Coast, Perth, Adelaide, or in surrounding areas such as Ballarat, Mt. Isa, Ipswich, the Sunshine Coast, Geelong, Newcastle, Wollongong, Mandurah, and more.

Pros And Cons of Rent To Own Cars No Deposit Near Me

The benefits and drawbacks of Rent To Own Cars are the same as those of most financial decisions. It is important to weigh the pros and cons of car loans and Rent To Own Cars before making your decision. You should consider each type of program to see if it’s right for you.

Pros of Rent To Own Cars:

- The application does not require a credit check. Compared to leasing or buying a car, rent-to-own contracts are easier to get. The lease-to-own option is highly viable thanks to its light requirements.

- There is no interest to pay. The Car is not financed unless you use dealer financing, so you don’t need to pay interest. The rental fee you pay each week is combined with the money toward the Car’s purchase.

- There is no impact on credit. When you are late with a payment, you will be charged a late fee, usually $25 – but your credit will remain unaffected. Your credit may be affected, however, if you use dealer financing.

Cons of Rent To Own Cars

- The price is high. A major disadvantage of any rent-to-own program is that you will pay much more than the product is actually worth. Your payments may not be paying interest, but the total amount you pay will exceed the Car’s value.

- There is a need for frequent payments. It will be more difficult for you to pay off your Car than the typical person who buys or leases one.

- A car warranty is not included. In the event your Car breaks down after you begin paying, you might not be covered under your rent-to-own contract if you don’t purchase a warranty outside of it.

Make sure you review the terms of your contract regarding early termination. Having this information can be crucial if the Car needs a lot of repairs. Several months or a year after your purchase, you might decide to end the rental. This could result in you losing your down payment and any money you paid for the Car under the terms of your contract.

FAQs

How Often Do You Make Payments with Rent To Own Cars Policies?

Weekly or biweekly payments will usually accompany the down payment for a rent-to-own policy. A car loan payment is generally made monthly, in contrast.

Do Rent-to-Own Cars Have Interest?

Car dealers generally charge regular payments when you rent a car with the aim of owning it. The payments are usually not subject to interest since they are used to cover the cost of the Car, not a loan. Make sure you compare renting to owning to other financing options, such as leasing or a subprime loan.

Conclusion

Check out all your options for buying a car before deciding on a rent-to-own one. To determine the best choice, you should compare the costs of a traditional auto loan with a rent-to-own deal and seek out lenders or credit unions that specialize in bad credit auto financing.

Make sure you read the contract carefully and understand all the terms before you decide to rent or own, including how much of the payment will go toward owning the Car and any fees.