Are you planning to buy a home with the Section 8 Housing Choice Voucher Homeownership Program? Your search ends here.

A Section 8 participant may be able to use their rental assistance voucher to become homeowners.

The Section 8 housing choice voucher program pays a portion of participants’ monthly rent. This program, administered by HUD, allows low-income renters, the elderly, and those with disabilities to afford rental housing.

Participants do not necessarily have to be renters. The vouchers they receive from Section 8 programs can also be applied to a mortgage payment. The guide will tell you everything you want to know about the Section 8 homeownership program.

Let’s get started.

Table of Contents

What is The Section 8 Program?

The Section 8 program provides housing assistance to low-income households, the disabled, and the elderly. The program provides vouchers to help participants pay for their rent in housing that meets the program’s requirements. Benefits.gov provides information on housing assistance programs, including Section 8, that can help eligible individuals and families.

How Does Section 8 Housing Work?

Section 8 is administered by public housing agencies (PHAs) in partnership with private landlords. Those eligible receive housing vouchers that cover a portion of their rent, making it easier for them to find suitable housing on the private rental market.

A household’s assistance depends on income, family size, and the local rental market. The voucher covers the remaining balance, with participants contributing 30% of their adjusted income towards rent. Section 8 Housing For Single Mothers to spend less on housing, freeing up resources for other essentials.

What is The Section 8 Homeownership Program?

A Section 8 homeownership program, also known as a housing choice voucher homeownership program, allows current Section 8 participants to convert their rental vouchers into homeownership vouchers.

This program involves paying a portion of the participant’s mortgage payment instead of paying a portion of their rent each month. A homeowner will typically need to contribute about 30% of their income to the program, while the program will cover the rest.

Not all public housing agencies provide a Section 8 Homeownership Program. You should inquire about whether your voucher agency offers homeownership.

How Does The Section 8 Housing Choice Voucher Homeownership Program Work?

There are other benefits of Section 8 that don’t apply only to renters. The HUD also allows Section 8 tenants to pursue homeownership through the use of vouchers. As long as you meet these requirements, you can leverage your voucher to build equity in your home rather than transfer it to a landlord.

Eligiblity Criteria For Section 8 Housing Choice Voucher Homeownership Program

A public housing agency that offers this program often has additional rules on top of the requirements established by HUD.

The following seven requirements must be met to qualify for Section 8 homeownership:

- Participate in a Section 8 housing choice voucher program.

- A minimum income of $14,500 is required each year (local agencies may require more).

- HUD defines “first-time homebuyers” as having never owned a home in the last three years.

- A minimum of 30 hours per week and one year of employment.

- Take part in homebuyer education and counseling.

- Having never defaulted on a mortgage while receiving Section 8 assistance

- Meet the requirements set by your public housing agency, such as a minimum savings balance or credit score.

- Even if you’re eligible, you’re not guaranteed to find and purchase a home. It’s important to have realistic expectations and to be prepared. If you know there will be barriers, be prepared to work on things such as your credit score or cash for a down payment.

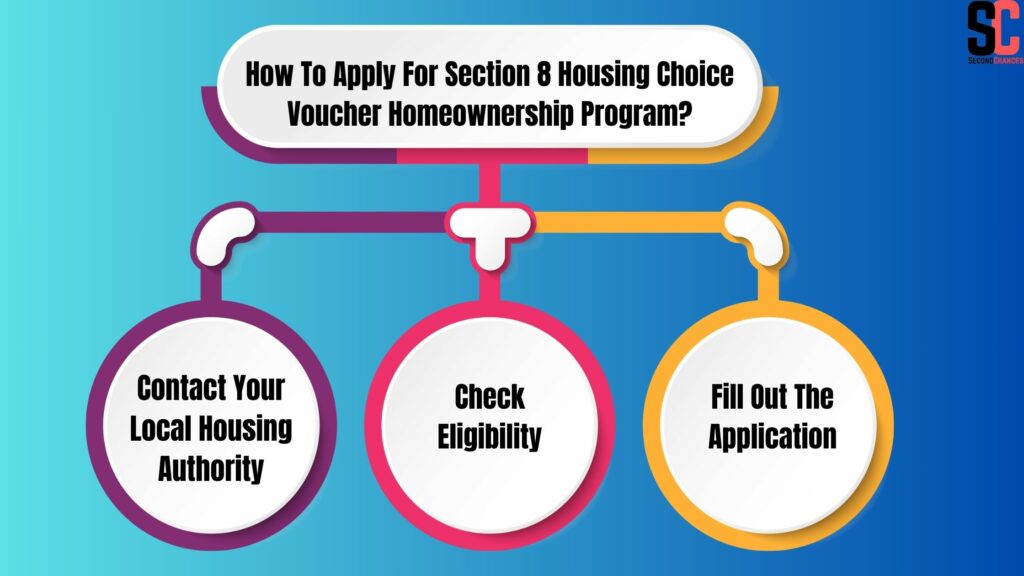

How To Apply For Section 8 Housing Choice Voucher Homeownership Program?

The application process for the Section 8 Homeownership Program can be lengthy and complex but generally follows the following steps.

Contact Your Local Housing Authority

You can find contact information for your local PHA on HUD’s website. You can begin the process by contacting them.

Check Eligibility

Contact your local PHA to find out if they offer a Section 8 Homeownership Program. The PHA may give priority to local applicants and homeless people.

Fill Out The Application

A Section 8 housing application can also be made through the PHA The information you provide will include your name, address, employer, financial details, and so on. In order to avoid further delays, make sure to contact your local PHA to ensure you have provided all the necessary information.

Rules of Section 8 Homeownership Program Voucher

There are a few extra requirements for homeownership vouchers that aren’t included in the standard Section 8 voucher rules:

- No one in your household owns a home, and you haven’t owned one for three years.

- You or anyone in your household cannot have received homeownership assistance in the past and defaulted.

- You must attend and complete a homeownership counseling course.

- In order to qualify for full-time employment, you must not be disabled or elderly.

Pros and Cons of Section 8 Housing Choice Voucher Homeownership Program

Pros of Section 8 Homeownership Program

A landlord often considers the benefits of Section 8 rentals when making a decision to allow them. It is essential to consider the cons, but it is also true that Section 8 houses for rent come with several advantages. Here are a few big pros to consider:

- The government will always pay your rent on time.

- The availability of Section 8 vouchers makes it easier to fill vacancies quickly.

- As Section 8 voucher holders struggle to find housing that accepts their vouchers, tenant turnover is generally low. However, there are opportunities for those seeking houses for rent by owner accepting the Section 8 program to find suitable accommodations, albeit with more limited availability.

- A smaller portion of the rent may make raising rent prices easier, as tenants may be less likely to complain about increases.

Cons of Section 8 Homeownership Program

There are several big benefits to creating Section 8 rentals, including fewer vacancies and guaranteeing rent will be paid each month. As a property owner, you should also consider the potential downsides. The following are some cons of renting Section 8 housing:

- The process of creating a new Section 8 rental unit takes a considerable amount of time and effort and is often time-consuming and costly.

- The first government payment for that unit can take up to two months after the first tenants move in.

- Section 8 rentals are subject to yearly inspections by local inspectors, and any repairs ordered by them must be completed within 6 months.

- Usually, tenants who qualify for Section 8 vouchers are low-income and may struggle even with a reduced rent payment.

- There are also drawbacks to Section 8 housing, such as higher crime rates or poorer tenant quality. There is certainly no hard-and-fast rule regarding this. A criminal background check on any potential tenant will protect you, your property, and your other tenants.

What To Know About Government Rent-to-Own Programs?

A rent-to-own agreement allows you to rent a property and then acquire ownership of it at the end of the term. There are many different rent-to-own contracts, so the rental payments could last from a few months to many years, depending on the contract.

The following are some of the advantages of rent-to-own assistance programs:

- The option to live in a home while awaiting a purchase

- A path to homeownership, even with a poor credit rating or no credit history

- Building equity while paying rent is possible for families.

- There is no down payment required.

The Housing and Urban Development Department provides funding for non-profit organizations that develop and administer homeownership programs. The organizations then assist people in purchasing and owning public housing.

The rent-to-own agreements offered by these HUD-financed organizations are mostly similar. The following are among them:

- The purchase price determines whether the home’s value will be current or predicted.

- The buyer sets aside a percentage of each rent payment as equity for a future home purchase. Therefore, rent for rent-to-own programs is usually higher than normal rent.

What Are The Responsibilities of The Tenant?

A one-year lease must be entered into with the landlord by the approved tenant. A security deposit and timely rent payment are required of the tenant.

- It is important for the unit to be well-maintained

- In the event of a change in income, the PHA should be notified

- In order to apply for a Section 8 Housing Choice Voucher or list a property, both tenants and landlords need to study the eligibility requirements provided by the Department of Housing and Urban Development.

HUD Related Programs And Notices

- All HUD programs require housing counseling to be provided by HUD Certified Housing Counselors. HUD implemented housing counseling certification as part of this statutory requirement. A PHA doesn’t need to be approved to participate in HUD’s Housing Counseling program (nor does its staff need to be approved to offer homeownership or housing counseling) if it doesn’t provide this service. Any homeownership and housing counseling done in connection with the HCV homeownership option must, however, be performed by a HUD-certified counselor working for a HUD-approved agency. The homeownership regulations are being updated to comply with this requirement by HUD.

- The HUD charges a special $200 fee for every homeownership closing. The yearly notices implementing the HCV program’s funding provisions provide more information.

- The HCV homeownership program is not the only program available in your state. This section provides information about programs that offer homebuying assistance in your state.

FAQs

Can You Buy An Apartment or House With Section 8 Homeownership Program?

The public housing agency that provides you with the Section 8 voucher may offer a homeownership option.

How Can Section 8 Help Me Move To Another State?

Yes! In Section 8, you can move anywhere in the country as long as you follow certain requirements. The PHA must be notified before you move, your current lease must be terminated, and new housing must comply with Section 8 requirements. Additionally, if you plan to transfer a Section 8 voucher to another state, you must follow the procedures outlined by the PHA in both your current and prospective states of residence.

How is The Amount of Rental Grants Determined?

In Section 8, rental assistance is determined by several factors, including an applicant’s income level, family size, and local market conditions. Rent is usually covered by vouchers, with participants contributing 30% of their adjusted income.

Do Section 8 Participants Have A Choice of Where They Live?

There is no doubt that one of the key advantages of Section 8 is that participants can choose from a wide range of housing options in the private rental market. In certain circumstances, they can select a Section 8 unit that meets their needs while accepting Section 8 vouchers.

How Long is The Waitlist For Section 8 Housing?

The waitlist times may vary significantly based on the location and demand for vouchers. The waitlist in some areas can be more than a year long. The local PHA should be contacted for information on the waitlist and application process.

Is It Hard To Get Approved For Section 8 Housing?

It may be possible for you to qualify for Section 8 housing, but it can take a long time for your application to be approved. It can take years for the PHA to approve homeless applicants.

What Are The Income Requirements For Section 8?

There is an income requirement of less than 50% of the area’s median income for Section 8 housing. Your family’s size and where you live will determine the exact amount.

Conclusion

The Section 8 Homeownership Program is designed to provide safe housing for low-income, disabled, and elderly individuals. You may have heard of Section 8 rental assistance, but this program can also help participants purchase a home and cover the costs of homeownership.